Iowa Governor Kim Reynolds’s tax reform proposal (HSB 671) is still alive in the House, as a Ways and Means subcommittee recommended its passage and review on to the full committee.

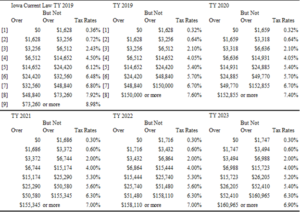

Reynolds released her tax reform proposal in mid-February, touting $1.7 billion in tax cuts through 2023, with the final, lowered tax rates being permanent going forward beyond the next five years. According to the bill, Iowa’s nine tax brackets would be reduced to eight, with a total of approximately 23 percent overall rate decreases. While the Republican-controlled Senate released its own version of tax reform, touting an annual tax cut of approximately $1 billion through 2022, House Republican leadership has stated it’s committed to working from Reynolds’ proposal. Prior to the state of the 2018 legislative session, Republican leadership in the House and Senate said that the two caucuses would approach tax form as united as they could be. Earlier this week, the Senate approved its $1 billion annual tax cut after having a committee vote just days prior, and just one day after the Iowa Legislative Services Agency (ILSA) delivered its analysis of the bill.

Figure 1: (Reynolds’ Tax Plan) Iowa’s current tax code and nine brackets, as they compare with Reynolds’ reduction to eight brackets and adjusted income levels. Photo Courtesy of Governor’s Office.

Chair of the House Subcommittee Peter Cownie (R-Distrct 42) said that he’d like to have a transparent process in achieving tax reform, and that he’d like to see passage of tax reform “after the second month” after the proposal was announced (mid April).

Lobbyists spoke during the public comment portion of the meeting, with a majority announcing that they were undecided on the governor’s legislation, and a few reasoned that Reynolds’ bill does not address Iowa’s corporate income tax rates, while the Senate bill does. According to the Tax Foundation, Iowa is one of the top states when it comes to high corporate income tax rates, topping out at 12 percent. Iowa is one of six states that levy a top marginal corporate income tax rate of 9 percent or higher. These statistics take Iowa off the list of potential sites for outside companies to establish themselves, lobbyists explained. Others said that because of the high amount of small businesses in the state that employ 10 persons or less, income tax reform was key to allowing small business be able to afford workers.

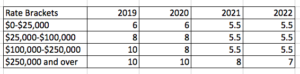

Above: Iowa Senate Corporate Tax Rate proposal from 2019 through 2022.

A key part of Reynolds’ tax reform that the subcommittee focused on is the inclusion of “triggers” that either induce tax cuts to continue, year after year, or stop the rates from declining. Adam Humes, Deputy Director of the Department of Revenue explained that these “triggers” protect the state should revenue decline, and reward the taxpayers if revenue comes in high.

Hume explained that in the first year that the bill would go into effect, in 2019, there would be no triggers, effectively making one tax cut that does not depend on the state’s revenue. For every tax rate decrease going forward through 2023, a tax cut will depend on the state’s revenue estimates as of the July 1 of the year prior. According to the bill, by November 1 after that July, the state will have to announce whether the tax cuts will continue to decrease. As a feature of the bill, whatever the tax rates are by year six of the legislation is what the rates will continue to be indefinitely, unless legislative action is taken.

Because of the mechanism and the reliance on revenues, Hume told the committee that if the tax legislation was in place today, following the first year of the tax cut, given the state’s current revenue amounts, a tax cut for next year would not happen. By this scenario, it is possible that tax decreases would slow and not reach their final cut level. In a previous interview with InsideSources, MacAllister Chair in Economics at Creighton University Ernest Goss said that while the income tax cuts are beneficial, as well as increased deductions for farmers, the biggest hurdle for farmers to overcome is commodity prices, which are not generating enough revenue in taxes, and that until those prices increase, economic growth will continue to be slow or stagnant.

When asked if the state could afford a revenue decline with Reynolds’ bill, Ryan Koopmans, chief policy advisor for the Reynolds Administration, said that the governor anticipates an approximate $60 million in revenue surplus that will offset the first year of tax cuts. Should any type of tax legislation not be passed this session, Koopmans said that Iowans’ taxes will increase because of federal deductibility. Reynolds and Senate and House leadership have made it known that the elimination of federal deductibility was a priority on all tax legislation.