With less than a week left in the regular 2018 legislative session, the debate on Iowa tax reform is raging on following the release of a proposal that would reduce Iowa’s income taxes by $1.3 billion over five years.

The proposal is being discussed as an amendment to current House Study Bill 671, which is Governor Kim Reynolds’ Iowa tax reform proposal that calls for a $1.7 billion tax cut over the same time span. Tax reform has been one of the top priorities of the Republican-controlled legislature and Reynolds, following the news from the Iowa Department of Revenue that Iowans’ tax liability to the state will increase as a result of the federal Tax Cuts and Jobs Act. Without any changes, Iowans’ are expected to pay $107 million more in tax year 2018, followed by $153 million more in tax year 2019.

The main reason that Iowans’ will owe more in income tax is due to the fact that it is one of four states in the U.S. with federal deductibility, which has an inverse relationship to federal tax policy. If taxes at the federal level go up, Iowans’ state liability goes down and vice versa. Interestingly enough, the House Republicans’ proposal doesn’t touch federal deductibility, and actually includes it in its proposal. Chair of the House Ways and Means Committee Guy Vander Linden (R-District 79) is quoted as stating that to include the removal of federal deductibility would prove too costly to the state when planning for budgets.

“Taxpayers will have a hard time figuring out what their burden actually is, especially now given the new federal tax law,” said Dr. Ernie Goss, MacAllister Chair in Economics at Creighton University, Nebraska. “So that makes it doubly difficult. Because of the reduction in federal tax rates, federal deductibility makes it hard to see that [benefit].”

One possible reason to include federal deducibility could be to ensure that the state maintains a solid revenue stream, in addition to providing some relief to middle class Iowans. Reynolds’ bill includes economic triggers that would decide whether or not the five-year tax cut continues on its course of various rate reductions. While the first year of tax cuts are not predicated on those economic triggers, every year afterward is dependent on the estimates gathered by the Revenue Estimating Conference (REC). Adam Humes, deputy director of the Iowa Department of Revenue, told a Ways and Means subcommittee last month that given the low revenue conditions currently facing the state, the tax rates following the first year of tax cuts in Reynolds’ bill would not go through, halting the tax cuts. By including federal deductibility, the state could still accomplish tax reform while ensuring that it maintains a revenue source, considering commodity prices have remained low, and the threat of a trade war on pork, corn, and soybeans could be dire to the Midwest. Goss said that if legislature was concerned about the costs of eliminating federal deducibility, then it could just have reduced the rate decrease.

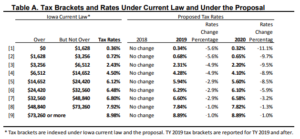

Tax Rates

The proposal doesn’t consolidate Iowa’s nine tax brackets, the way the Senate-approved bill does. Overall, by tax year 2020, the aggregate tax brackets would see the following rate reductions, with those making $24,420 seeing the largest rate reductions. Overall, Iowan’s income taxes would be reduced by $139 million in tax year 2019 and $298 million in tax year 2020.

Iowa House Republican proposed rate changes as an amendment to Iowa Governor Kim Reynolds’ proposal. Provided by Iowa House Republicans.

According to the Iowa Department of Revenue, the average decrease in tax liability for someone making between $20,000 and $30,000 annually would be $103. For those making between $30,000 and $40,000, the average decrease in tax liability for someone would be $123. All rates and average impacts can be found in the distributed Committee Plan Run.

The proposal increases the standard deduction in the state to $3,000 for singles and $7,500 for families, and indexes it for future years. The previous rate was $2,070 for singles and $5,090 for families. While the proposal doesn’t address the corporate tax rate the way the Senate bill does, it creates a “small business” deduction for 25 percent of the federal qualified business income deduction, from state taxable income. In addition, the proposal raises the Section 179 (purchasing of equipment for business use) limit to $100,000/$400,000 (up from $25,000/$200,000) in 2018, and raises the limit again to $250,000/$1,000,000 in tax year 2020. Goss said that given the state of the farm economy forecasting low gains, expanding Section 179 will be helpful for farmers looking to purchase equipment in low revenue periods.

The bill would severely impact the way Iowans shop, mainly online. State sales tax would be assessed to online retailers like “Zappos and Wayfair,” (though the U.S. Supreme Court has not yet issued a ruling on a South Dakota case on charging sales tax on retailers outside the state’s borders), as well as charging sales tax to third party sellers. The sales tax would also be assessed to online streaming services such as Netflix and Hulu, as well as on services like Uber and Lyft. Goss said that by applying sales tax to streaming services can generate “a lot of money” throughout the state, given the state of the modern economy migrating to online, subscription models.

Goss said it would be interesting to see the legislature produce a proposal addressing retirees, given that a large sector of the economy is bracing for the retirement of Baby Boomers. Goss said that the legislature should also examine the tax incentives it has been giving out to corporations to locate their businesses here, as that could be used to offset tax cuts.

Going forward

With only several days in the regular legislative session remaining, both bodies will have to come to an agreement on what type of plan they’d like to pass. The Senate-passed bill is a $1 billion tax cut annually, that also includes corporate tax reform. Both Reynolds’ bill and the House proposal do not include corporate tax reform. The House proposal does not touch federal deductibility, while Reynolds’ and the Senate’s bills do. Disagreements between Senate and House Republicans have been pronounced in this legislative session, with disagreements on how to address water quality as well as what to do with traffic cameras. Democrats tend to be on board with the removal of federal deductibility, but with revenues unstable, making large tax cuts could be a hard sell.