With closed-door negotiations commencing among the Republican caucuses in both the House and Senate chambers during an Iowa Legislative overtime, it’s apparent that a solution to the financial impasse between both chambers will not come by the end of this week, and could continue into the weekend. While budget targets have been released from both caucuses, dependent on their respective tax plans, the plans drastically impact the state’s financial stability in a more unpredictable economy, given proposed tariff increases on Iowa farm exports and historically low commodity prices.

The proposed Senate tax plan calls for $1 billion in annual income tax cuts, with corporate tax reform a feature in the bill, as well as eliminating federal deductibility. The House plan starkly differs in that it proposes $1.3 billion in Iowa income tax cuts over the next five years, with no corporate tax reform, and keeping federal deductibility in place. The House’s inclusion of federal deductibility is a differing opinion from both the Senate as well as Republican Governor Kim Reynolds. With time to review both chambers’ tax plans, the Iowa Legislative Services Agency (ILSA) released its non-partisan analysis on how the plans will affect the state’s revenue stream and expenditures.

The Senate Republicans’ tax plan reduces Iowa’s nine income tax brackets down to five, the lowest being five percent and the highest being 6.6 percent, in 2019. Currently, Iowa’s tax brackets range from 0.36 percent, to 8.98 percent. In the year 2020, under the proposal, the highest bracket drops down to 6.5 percent, then subsequently drops 0.1 percent until 2022. For the corporate tax provision of the plan, Iowa’s brackets go from four to two in 2021. Instead of ranging from six percent to 12 percent on the four brackets, the plan’s two brackets would be 5.5 percent for business making under $250,000, annually, and seven percent for businesses making over $250,000, annually.

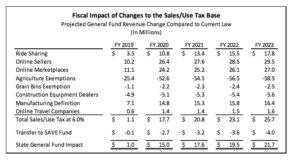

In terms of offsets to the tax cuts, the Senate plan lumps in-state credit unions with banks for franchise taxes, which are two percent for the first $7.5 million of net income, then four percent on net income above $7.5 million. The plan also expands sales tax to online purchases and ride-sharing services, as well as other goods. The plan also retires and caps certain tax credits, while expanding others.

According to ILSA, the current estimated revenues from state income taxes under current law are approximately $4.071 billion in fiscal year 2019. Under the tax proposals, that estimate drops down to approximately $3.375 billion. In fiscal year 2023, under current tax law, ILSA forecasts income tax revenues to be approximately $4.545 billion. Under the tax proposal, that number would be approximately $3.497 billion — a difference of over approximately $1 billion, or 23 percent.

For corporate income tax, forecasts under current law are estimated at approximately $478 million in fiscal year 2019. Under the tax proposal, that estimate is approximately $422 million. In fiscal year 2023, under current law, ILSA forecasts revenue to be approximately $514 million. Under the tax proposal, that number is estimated to be approximately $247 million — a reduction of over 50 percent.

The impacts of the Iowa Senate tax proposal for sales tax modifications and their impacts on state revenues. Iowa Legislative Services Agency

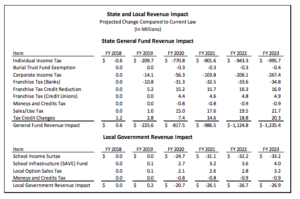

Fiscal impact of the Iowa Senate tax plan. Courtesy of the Iowa Legislative Services Agency

After calculating for income and corporate tax reforms, as well as sales tax and tax credit adjustments, ILSA anticipates the state will see a reduction in general fund revenue of approximately $225 million in fiscal year 2019. In 2020, this number nearly quadruples to approximately $817 million. By the year 2022, the reduction in revenue totals approximately $1.124 billion. For reference, the Senate fiscal year 2019 budget targets are at approximately $7.484 billion. The Health and Human Services portion of those budget targets are approximately $1.835 billion. As for the impact on local government revenues, beginning in fiscal year 2020 and beyond, local government will see reductions in school income surtax of approximately $24.7 million, maxing out at $33.2 million in fiscal year 2023.

The House tax plan keeps Iowa’s nine-bracket system, reducing bracket rates from the current 0.36 percent-8.98 percent, down to 0.34 percent-8.89 percent in fiscal year 2019, and 0.32 percent-8.89 percent in 2020, and smaller adjustments onward through 2023. The House plan does not alter corporate taxes and maintains federal deductibility.

For offsets to the income tax cuts, the House plan expands sales tax to digital goods (charging six percent on digital downloads), expanding sales tax to purchases made online, as well as streaming services, and expands the hotel/motel tax.

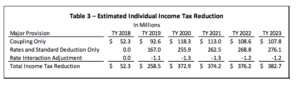

The Iowa House tax bill has two individual income tax features: it generally couples Iowa tax law with federal tax changes that Iowa tax law is not currently coupled with. It also lowers tax rates while increasing the standard deduction. ILSA says that roughly one-third of the income tax reduction is due to the coupling provisions, while two-thirds is the result of reduced rates and the increased standard deduction. Courtesy of ILSA

According to ILSA, the current estimated revenues from state income taxes in fiscal year 2019 are approximately $4.071 billion. Under the House tax proposal, that number would be approximately $3.83 billion — a reduction of 6.3 percent. The estimates for fiscal year 2023 under current tax law are approximately $4.546 billion. Under the proposal, that number would be approximately $4.164 billion — a reduction of 8.4 percent.

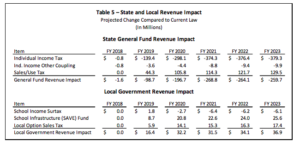

The fiscal impact of the Iowa House tax plan on state revenues. Courtesy of Iowa Legislative Services Agency

After calculating for income tax deductions, sales tax expansions, as well as coupling, ILSA anticipates that the state will see a reduction in revenue of approximately $98.7 million in fiscal year 2019. In fiscal year 2020, that reduction increases to approximately $196.7 million. By fiscal year 2023, that reduction reaches a total of approximately $259.7 million. As for the impacts on local government revenue, ILSA anticipates large growth in local option sales tax dollars, as well as increases to the Securing an Advanced Vision for Education (SAVE) fund.