On November 6, 2015 the China Securities Regulatory Commission allowed IPOs in China to resume, lifting the suspension it imposed four months ago. The first batch of 28 companies, the Commission announced, would be listed by the end of the year. The move, which came as China’s stocks rallied back to bull-market territory, was welcomed by optimistic observers who think that China’s securities watchdog is finally correcting the heavily criticized measures taken over the summer.

Those optimistic about the IPO resumption are likely to be disappointed again. As initial public offerings resume — for the ninth time since the creation of the China Securities Regulatory Commission in 1992 — the regulators are simply going back to the decades-old, flawed practice of micro-managing IPOs in China.

In China, the issuance of shares is overseen, through secretive and arbitrary ways, by the regulatory agency. All IPOs must be approved by a screening committee made up of representatives from the private sector, such as auditors and lawyers, and government bureaucrats. The criteria for selecting committee members are not known to the public. Neither are the conditions companies need to meet in order to pass the screening.

This secret control of the process to issue new shares has crippled the development of China’s stock market for years.

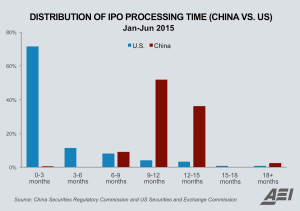

China’s regulators ultimately control if, and when, companies will be listed on the stock market. In the first half of 2015, it took the Commission between two months to three years to process the IPOs that had been approved. It is mind-boggling to compare the time needed by China’s securities regulators to process applications, and the time spent in the U.S. where companies simply register to be listed on the stock exchange (see figure). It usually takes no more than three months for the U.S. Securities and Exchange Commission to process IPO applications.

Besides the obvious — such manipulation renders the stock market not free — this often prevents the issuing companies, who are raising money to invest, from taking advantage of good business opportunities. In the first quarter of 2013, 20% of the would-be IPOs in China had withdrawn their applications after having waited for too long, in addition to another 20% who had seen their applications rejected. In many cases, even if a company finally obtains the screening committee’s approval for an IPO, the investment project it issued the new shares for may no longer be profitable.

The Securities Regulatory Commission’s control of IPO approvals also weakens the protection of investor interests in China — the exact opposite of what the securities watchdog is supposed to do. Because it is of tremendous value to the issuing companies to obtain the Commission’s approval quickly, it has become common practice for these companies to hire politically-connected intermediaries during their IPO applications. Twenty-five of the 28 companies meant to be listed before year-end have hired auditing or law firms with senior executives who sit on the Commission’s screening committee. The current system rewards auditing and law firms who have connections to the securities watchdog, not those who can provide investors with the best accounting and legal information about the issuing companies. Investors are harmed by this type of cronyism as the quality of information being disclosed is compromised.

For the stock market to develop properly in China, a reform of the current, flawed IPO system is badly needed. Even though there has been much talk of reforming China’s system of share issuance to one that resembles the American system, including a new promise by the regulatory body in its latest announcement, the pace of actual reform remains agonizingly slow.

The November 6 IPO resumption represents nothing more than a restoration of the secretive and arbitrary regime that has prevailed for years. Unless China pursues real reform of its share-issuance process, the controlling hand of the securities watchdog will be around for much longer.