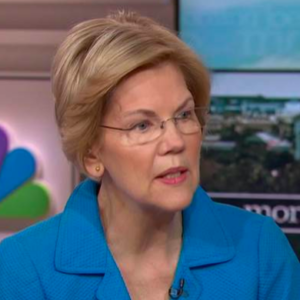

Outspoken progressive and 2020 presidential hopeful Elizabeth Warren wants to impose a 2 percent “wealth tax” on every American with $50 million or more in assets to pay for her free college and free childcare proposals.

“If we put that two-cent wealth tax in place on the 75,000 largest fortunes in this country — two cents — we can do universal childcare for every baby, zero to five, universal pre-K, universal college and knock back the student loan burden for 95 percent of our students,” Warren said at an April town hall.

Warren and her economic advisors claim the plan will “bring in $2.75 trillion over a ten-year period.”

Critics of her plan say the tax won’t bring in nearly the revenue as she says it will, and that there is no efficient and effective way to value the wealthy’s assets.

Warren’s plan revolves around using existing valuation methods used for the estate tax, but the rich are historically quite adept at manipulating loopholes to avoid the tax. She also plans to authorize the IRS “to use cutting-edge retrospective and prospective formulaic valuation methods for certain harder-to-value assets like closely held business and non-owner-occupied real estate.”

Under the wealth tax, the IRS will value the richest Americans’ coin collections, cars and paintings in addition to other business and real estate assets, similar to the way they value wealth under the estate tax. But using estate tax valuation methods and beefing up the IRS isn’t so simple.

For years Congress has slowly chipped away at the estate tax’s exemption threshold, enabling the rich to keep more of their wealth. In 2000, the threshold was $675,000. Congress raised it to $1 million in 2001, then to $3.5 million in 2002, then briefly repealed the estate tax altogether in January 2010 only to bring it back under President Barack Obama with a $5 million threshold in 2010.

President Trump’s 2017 tax-cut package doubled the estate tax exemption threshold to $11.5 million, and also scheduled for it to expire after 2025, according to the Tax Policy Center. The Tax Foundation also notes that estate tax revenue constitutes less than 1 percent of the federal budget, partially due to the high exemption threshold. And as the tax burden rises, wealthy taxpayers will be more motivated to hire lawyers and look for tax shelters for their taxable assets.

Caroline Bruckner, managing director of American University’s Kogod Tax Policy Center, told InsideSources that Warren’s wealth tax could end up enriching lawyers instead of providing a reliable source of revenue for her initiatives, like universal childcare and student debt forgiveness.

“Anytime there is auditing with the ultra-rich, what people aren’t talking about here is the resulting litigation that’s going to happen, because there’s no way the ultra-rich aren’t going to fight valuation and bring in their own economists,” Bruckner said. “As it is right now, the IRS simply doesn’t have the personnel to tackle the audits of this kind of scale. I don’t think it’s impossible, I just don’t think the very wealthy are going to go down without a fight. Very wealthy people are going to hire the very best lawyers, who are just in some cases going to be able to run circles around auditing teams at the IRS.”

But Bruckner thinks using estate tax valuation methods isn’t such a bad idea.

“In the 1970s the IRS audited 60 percent of estate returns, but over time, and in the last 10 years, the estate tax has been modified by Congress so that exemption levels got so high that barely anyone was subject to it, and on top of that the audit rates fell,” she said. “[So] is there anyone really paying it?”

In other words, prioritizing the IRS’ enforcement and auditing authority will be key to making Warren’s wealth tax work. Because Warren is campaigning and not proposing specific legislation, she doesn’t offer many details on what an aggressive IRS would look like. To avoid litigation from the wealthy over the tax, Bruckner says Warren will need to write very detail-specific legislation.

“You want policy that’s going to minimize litigation through the audit process,” she said. “Right now Facebook is being sued by the IRS and all of that litigation is about how Facebook valued the IP it moved out of the U.S. to Ireland.”