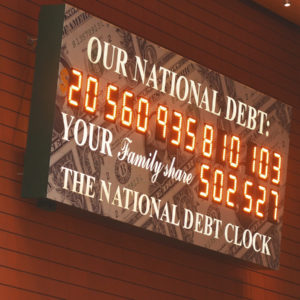

On September 21st, the Congressional Budget Office released a long-term outlook on government debt. In a dire warning the CBO projects that in 2050 the debt will equal 195 percent of GDP.

A debt explosion of this magnitude should rightfully send shivers through the country. This is a mounting national crisis that transcends party lines and ideological affiliations. Both parties in Congress have gone AWOL on this issue, and both Donald Trump and Joe Biden carefully ignore the problem.

This political inaction is, frankly, inexcusable. By remaining deadlocked in partisanship, Congress is rapidly running out of time to proactively address the crisis. This will have devastating consequences for generations to come.

The lack of fiscal responsibility in Congress was put on full display during the COVID-19 shutdown. There is emerging data from the Bureau of Economic Analysis (BEA) that shows that our elected officials drastically over-sized their stimulus spending.

It is perfectly reasonable that Congress compensates the private sector when businesses are ordered to close. But as the BEA numbers show, this compensation went far beyond any reasonable proportions.

In the second quarter of this year, America’s households received $254 in unemployment benefits for every $100 they lost in work-based income.

Then there were the stimulus checks, which the Treasury began sending out in May. If we add them to the unemployment benefits, Americans got $566 from the government for every $100 we lost in income.

Again, it is perfectly reasonable that government compensates for income losses it inflicts on people by forcing their workplaces to close. What is not reasonable is this drastic over-sizing of the compensation — especially at a time when the government is already borrowing up to a quarter of every dollar it spends.

To make matters worse, looking again at BEA data, states and local governments have received $200 billion in stimulus money that they did not need. Their spending remained largely unchanged at about $750 billion per quarter, and their regular revenue — not counting the extra federal money — was largely on track with 2018 and 2019.

While some states took a fiscal beating, most of them rely predominantly on property and sales taxes, plus fees and other charges. These income sources remained largely unaffected by the economic shutdown.

Irresponsible over-spending during the economic shutdown has significantly exacerbated the debt problems that the CBO points to. Congress needs to immediately set aside all partisanship and develop a master plan to save our nation from a debt crisis.

That crisis sets in when investors lose faith in the government’s ability to make debt payments. Creditors demand higher interest rates and shorter debt maturities. Interest rates rise — and rise fast. The now classic example is Greece: when the debt crisis became acute in 2010 interest rates rose to 25 percent.

During the Swedish debt crisis in the early 1990s interest rates topped out at an unbelievable 500 percent. The economy ground to a complete halt, the currency crashed and parliament rushed to execute an austerity plan that raised net taxation on the economy by seven percent of GDP.

Which brings us to the next phase of a debt crisis.

In order to resume buying Treasuries, investors will demand that Congress raise taxes and cut spending — and do it now. There will be no time for thoughtful spending reforms, no time to evaluate the long-term consequences of the tax hikes. The more draconian measures Congress takes, and the sooner they do it, the more satisfied the debt market will be.

If the U.S. crisis would be followed by austerity at the Swedish level, Congress would raise taxes and cut spending by an equivalent of almost $1.5 trillion. If they followed in the Greek footsteps, things would get even worse.

After a dozen austerity packages over a period of five years, the Greek government had cut its entitlement programs by 50-90 percent, almost wiped out unemployment benefits and cut health care down to the bone marrow. Housing benefits for the poor were cut by 90 percent.

Taxes increased from 39 to 50 percent of GDP. Greece lost one quarter of its economy. That is $5.5 trillion by U.S. standards. The country has still not recovered from this destruction.

Some would suggest that we continue relying on the Federal Reserve to monetize our debt. That will inevitably lead to hyperinflation; long before that, already at 10-20 percent per year, inflation wreaks havoc on an economy.

Another option is what bureaucrats call “debt restructuring.” In plain English we call it “debt default.” The U.S. Treasury would decide to not pay back part of what it owes its creditors. In 2012 the Greek government defaulted on 25 percent of its debt.

None of these options — austerity, monetization and debt default — are even remotely desirable. The only alternative is for Congress to start working, right now, on a debt-containment master plan. If it does, it can return us to a path of fiscal soundness.

If it doesn’t, well, then God help us all.