As China’s stock market resumed its plunge last week, the Chinese government’s foray into the securities industry is changing focus — again. In an effort to stop the latest meltdown, Chinese securities regulators once again revived their unpredictable rule-making, and halted the intense wave of stock-market probes — which they had started during the last market upswing — that caught scores of senior executives in state-owned firms, top-flight Chinese traders, and high-profile international investors.

Malfeasance may or may not be common in China’s securities market, but it certainly did not rise and decline abruptly in recent months. The real problem for China is not the misconduct of market participants — it’s the incompetence of securities regulators. Due to the legal system’s lack of checks and balances, the China Securities Regulatory Commission (CSRC), the agency overseeing China’s stock market, has long engaged in arbitrary and inconsistent enforcement. Now that share prices in China have plummeted again, the regulatory body is very likely to look for the next scapegoats to blame.

For years, regulatory enforcement without legal certainty has depressed both domestic and foreign investors in China, who desperately need a rule-based securities market. As China’s dollar-denominated $80-billion Qualified Foreign Institutional Investor (QFII) program — created to allow foreigners access to China’s capital markets — keeps growing, inconsistent enforcement will surely become even more disturbing for international investors, most of whom come from countries with the rule of law. The most pressing need for China’s stock-market development right now is for the Chinese government to bring common sense and stability to its regulatory regime — and not another round of irrational rules.

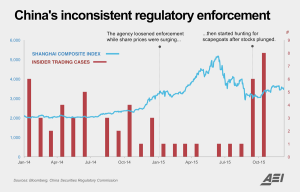

China’s probes on insider trading, for example, have been alarmingly inconsistent. Although the Securities Regulatory Commission is empowered by law to fine firms and individuals whenever it sees fit, from 2001 to 2007 it imposed fines in only two cases, compared to 36 in 2014 alone. In this year’s boom-and-bust cycle, the agency loosened enforcement while share prices were surging, then started hunting for scapegoats after stocks plunged (see figure). Instead of building legal certainty by consistently catching and punishing misdeeds, the regulatory body has tried to use its enforcement powers to steer market direction.

Underlying the inconsistent enforcement is the Securities Regulatory Commission’s unchecked powers “given” by China’s weak judiciary. Last year, CSRC’s action in China’s highest-profile insider trading case was challenged in court by one of the accused traders. The legal proceedings highlighted the lack of constraints on the regulatory body, and the difficulties private parties face in fighting unjust enforcement.

The insider trading case arose from a 2013 computer malfunction at Everbright Securities, a Chinese brokerage firm. The glitch caused the firm’s proprietary trading unit to take a seven-billion-yuan long position, pushing the benchmark index up by six percent. The firm later unwound its position by placing sell orders and index shorts. The Regulatory Commission decided that the erroneous buy was a form of inside information held by Everbright, and that its subsequent sell was an act of insider trading. The agency punished the firm and its executives with a record fine of 438 million yuan. The head of Everbright’s proprietary trading unit brought the case to court, arguing that the mistaken buy was not inside information.

The oral argument in the case exposed both the regulatory body’s broad discretionary powers under the law, and the court’s determination to uphold the agency’s decisions with little regard for facts.

It is shocking to realize how much freedom the China Securities Regulatory Commission has to define the misconduct it is supposed to punish. In court, the agency cited a legal provision stating that “any information the Commission recognizes as important, and as having a marked effect on the trading prices of securities is inside information.” Because the regulatory body “recognized” Everbright’s long position as inside information, it viewed the subsequent unwinding of the position as insider trading. Although the firm’s trading chief argued hard against this point, the judges were apparently uninterested. Unsurprisingly, because there is no separation of powers between the legislature and the securities regulatory agency, the judiciary simply has no real role to play.

Nevertheless, the judges did challenge one key point. They asked the agency three times: since Everbright’s proprietary trading unit was investing the firm’s own money, would the Commission view all transactions big enough to have “a marked effect” automatically as inside information? Shouldn’t all traders making those transactions be required to disclose such inside information before being allowed to make subsequent trades? The Commission’s point person kept avoiding the questions by citing Everbright’s obligation to disclose information as a listed company, an issue completely irrelevant to the disclosure obligation of a market trader.

The questions suggest that the judges realized that a ruling for the regulatory body would have a detrimental effect on China’s financial development. Nonetheless, they still ruled for the agency.

The court’s verdict has vividly exposed the frailty of China’s legal system. The verdict largely rephrased the Commission’s argument as it was, being completely silent about the debate between the judges and the agency’s point person. To date, China’s judiciary remains too weak to get in the way of the country’s regulatory body — and the powerful Chinese government it reports to.

While the Chinese government ostensibly considers regulatory agencies in western countries — such as the U.S. Securities and Exchange Commission — as the model for its securities regulation, it still doesn’t realize what is missing from its own system. The China Securities Regulatory Commission doesn’t need more investigations — it needs more checks and balances on its investigators.

The development of China’s stock market in the past 25 years has been remarkable. But the current regulatory regime is clearly incapable of advancing and sustaining such development — not in financing economic growth in China, or in attracting investment from abroad.

There is no lack of desire in China for opening up its securities market to more international investors. But, without clear rules and consistent enforcement, China always has to face an inconvenient truth: even if you build it, they won’t come.