The Israeli economy, despite facing headwinds from a resurgence of terrorism, remains an incredible example of a developed country’s ability to achieve sustained economic growth. Israel’s continued growth is a strong testament to the powerful influence of a market-based, democratic economy and the virtues of a well-educated and disciplined labor market. It is a record built on strong foreign direct investment (FDI), an embrace of technology and entrepreneurship, and a capable labor force. But while its growth has been impressive, Israel must not rest on its laurels. An increasingly global economy where foreign investment flows can be easily redirected to the most welcoming economies means that Israel must remain vigilant in its efforts to attract investment.

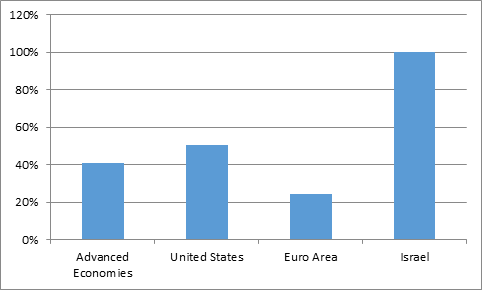

Earlier this month, the International Monetary Fund (IMF) released its latest forecast for economic growth around the world. Among the 37 advanced economies identified by the IMF, only three did not experience a contraction in the aftermath of the global financial crisis: South Korea, Australia, and Israel. The IMF projects 3.3 percent growth for Israel in 2016, among the highest growth rates for all developed nations. Moody’s Analytics recently maintained Israel’s A1 government bond rating, noting both Israel’s lower debt-to-GDP ratio than pre-financial crisis (a rarity among advanced countries) and its below-target budget deficit for 2015 (at 2.5%). As the accompanying chart illustrates, Israel’s economy has doubled in size since 1996 while the U.S. economy has increased just 50 percent and the EU economy just 24 percent.

Aggregate Real GDP Growth, 1996-2014

Source: International Monetary Fund, World Economic Outlook, October 2015.

What drives this performance? In their book Start-Up Nation, Dan Senor and Saul Singer identified the positive effects of the Israel Defense Force (IDF) on work ethic, entrepreneurship, and social networks. But there are additional factors at play. Despite a huge defense budget, Israel maintains a strong infrastructure and excellent educational system while also achieving a tax burden lower than most OECD nations. Israel relies on consumption taxes more than most nations and, according to the OECD, has kept its VAT rate at 18 percent, slightly below the average for other developed nations.

Unfortunately, there are some negative economic developments in Israel detracting from these positive trends. In late 2013, the Israeli Knesset adopted increases in the Israeli corporate tax rate that will send the wrong signal to foreign investors seeking to build factories in Israel and to Israeli corporations contemplating whether to expand domestically or abroad. In fact, preliminary OECD data indicate that FDI into Israel dropped by nearly half from 2013 to 2014. As I’ve written previously and has been reported in the Israeli press, a pro-growth business tax system is more important to a small and open economy like Israel, which faces stiff competition from Ireland and other small countries, than it is to larger economies like the United States.

Similarly, political stability within Israel and in the region are necessary for Israel to attract and retain both high-quality human capital and essential foreign capital. Israel is fortunate in that it remains a global hub of high-tech research and its engineers are revered for their innovations. Intel, Microsoft, Google, and others are all major players in Israel’s high-tech economy. But Israel must seek to broaden and diversify its economic footprint. In addition to a globally competitive tax policy, Israel must continue to pursue a high labor force participation rate. Together, these two strategies – more capital and more labor – will help Israel continue to experience above-average economic growth and realize higher living standards for its citizens.

As the Israeli government works to ensure not only the physical safety of its citizens but their economic security as well, it needs support against efforts to inhibit the very trade and investment that has propelled its growth. Much as Israel must constantly pursue strategies to maintain global competitiveness, the rest of the global economy must work to thwart efforts to embargo Israel or limit its participation as an equal partner on the world stage.