Senate Republicans took a major step towards implementing their tax overhaul goals early Saturday morning by passing their version of the legislation on a 51 to 49 vote.

The Tax Cut and Jobs Act could have a huge impact on taxpayers across the country. Republicans promise the bill will help boost economic growth by reducing rates and simplifying the tax code. House Republicans were able to pass their version of the legislation Nov. 16. The Senate doing the same now means the two chambers can enter a process to resolve differences between them – a necessary step before the plan can be signed into law.

President Donald Trump has been highly supportive of the plan and is likely to sign it into law when given the chance. The president and his administration have consistently praised the plan in recent months during speeches and press conferences. He also met with members for a closed-door meeting Tuesday to discuss the bill and rally support.

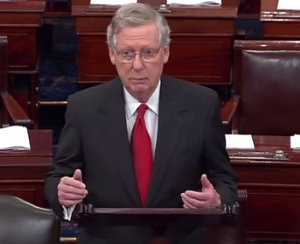

Senate Majority Leader Mitch McConnell decided to delay a vote on the bill Thursday evening due to lingering disagreements among party members. The bill is expected to increase the deficit substantially which has prompted concern among some fiscal conservatives. Republicans considered a provision that would have automatically triggered higher tax rates if the bill didn’t result in enough economic growth to offset the deficit as much as they projected. The Washington Examiner reports that the provision was deemed to be in violation of Senate rules which prompted the delay.

Republicans were still writing their bill into the night on Friday hours before the vote to include last minute changes. Democrats bashed them on the floor during the debate that evening for formulating a final bill so close to the vote – leaving little time to read and research it with the new provisions included. Democratic Sen. Sherrod Brown argued they need to slowdown and work on a bipartisan bill that actually helps the middle-class.

The Senate tax bill maintains the current seven income brackets but reduces the rates for most of them. The bill taxes the highest income taxpayers at a slightly lower rate of 38.5 percent, followed by rates of 35 percent, 32 percent, 24 percent, 22 percent, 12 percent, and 10 percent. It also includes an unofficial zero percent tax rate for the lowest income earners by doubling standard deductions.

The Senate bill is also written to lower rates for smaller and larger companies in the hope of boosting economic growth. The Tax Foundation found in an analysis Nov. 10 the bill could cause a significant increase in economic growth at 3.7 percent over the long-run. That growth could lead to 2.9 percent higher wages and an additional 925,000 full-time equivalent jobs. Those numbers may change when the last-minute changes are factored in.

The Wharton Business School at the University of Pennsylvania has been far less optimistic about how the bill would help economic growth. It found that the legislation would bring just 0.8 percent in additional economic growth by 2027. By 2040, the bill would only add a 0.5 percent increase in economic growth, while also risking a negative 0.2 percent drag on economic growth.

The bill reduces the top rate for C corporations from the current 35 percent down to 20 percent. These companies are often larger and structured so the tax rate is applied to the company itself as opposed to the owners. Many smaller businesses could also see a lower rate with the bill including a 23 percent deduction on pass-through income. That deduction was originally placed at 17.4 percent but was raised during last-minute discussions after the vote was delayed.

Pass-through businesses are structured so that the owners are directly taxed on their income – instead of having the corporate rate applied to their company. These businesses include sole proprietorships, partnerships, and S corporations. They are often, but not always, small and family owned.

The stock market at least appears to be responding positively to even the promise of having this tax reform plan passed into law. CNBC reported that stocks rallied on Thursday. The Dow Jones industrial average increased by 300 points allowing the stock market to break above 24,000 for the first time.

Republicans have faced plenty of opposition in their effort to reform the tax code, especially when it comes to the deficit and which deductions and exemptions the bill eliminates. The goal of eliminating or reducing certain deductions is to make the tax code simpler and fairer – but that could impact some middle-class taxpayers that rely on them, despite the promise the bill is intended to help them.

The Senate bill would reduce what are known as state and local (SALT) tax deductions. SALT deductions allow taxpayers who itemize to deduct some of their local taxes on their federal taxes. The legislation caps the deduction at $10,000 and excludes income or sales taxes. The bill originally scrapped the deductions completely, but that was reined back during the last minute changes.

The legislation is also likely to increase the deficit substantially which could slow economic growth down the line. The Joint Committee on Taxation found in an analysis Thursday that the bill would add $1 trillion to the national deficit over the next decade, even with projected economic gains taken into account. The United States already has a running deficit which has added trillions of dollars to the national debt.

Republican Sen. Jeff Flake and a small group of others within the party have expressed concern over how the bill would impact the deficit. Sen. John McCain decided to support the bill, despite his own concerns about the deficit, roughly a day before the vote the delayed vote, noting it’s not perfect but would do a lot of good for the economy. He famously became the deciding vote which killed an earlier effort to repeal the Affordable Care Act.

Senate leaders have entertained several ideas to ease those concerns including the tax increase trigger and federal spending cuts. Sen. Bernie Sanders challenged supporters to guarantee they would not make cuts to entitlement programs during a heated exchange on the floor Thursday evening. AARP, a leading advocacy and lobbyist group for the elderly, expressed concern over how those spending cuts would impact social and health services.

“The large increase in the deficit will inevitably lead to calls for greater spending cuts, which are likely to include dramatic cuts to Medicare, Medicaid, and other important programs serving older Americans,” AARP said in an open letter Thursday. “We urge Congress to work in a bipartisan manner to enact tax legislation that better meets the needs of older Americans and the nation, and we stand ready to work with you toward that end.”

The Senate bill also includes a provision which repeals the individual mandate, a critical component of the Affordable Care Act, better known as Obamacare. But that provision has become a highly contested part of the legislation. The individual mandate is a requirement under the healthcare law that imposes a tax penalty on anyone who isn’t covered by health insurance or a public insurance program like Medicaid.

The House version of the legislation includes a number of differences – particularly in how it handles deductions, pass-through businesses, and the income tax brackets. It would reduce the seven current income brackets down to four. Both chambers will have to form a conference committee together to resolve those differences in order to pass identical bills.