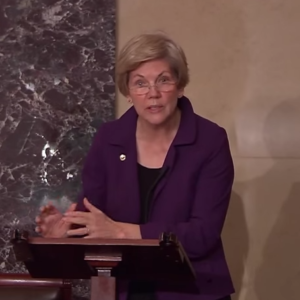

In her recent impassioned Senate speech against the repeal of the swaps push-out provision of the Dodd-Frank Act, Senator Elizabeth Warren argued that a vote for repeal was a vote, “…[to] let derivatives traders on Wall Street gamble with taxpayer money. ” Senator Warren’s attack rests on the widely held notion that credit default swaps increase the normal risks taken by banks.

The Senator has been misinformed. Credit default swaps (CDS) are relatively simple insurance-like contracts that involve the same risks as products that we routinely expect banks to provide—commercial loans.

When a bank makes a loan, it transfers cash to a borrower. A well-run bank will have investigated the borrower’s credit history, the intended use for the funds, and evaluated the borrower’s capacity to repay the loan. But there is no way to predict the future. Circumstances change, plans can go awry, and despite diligent underwriting, the loan may default and the bank may not recover the loan balance. The fact that the bank has no control over what happens to the funds it has lent makes lending one of the riskiest bank activities.

What, then, is a credit default swap? Despite its intimidating name, the CDS is a simple transaction. It’s best understood as a kind of insurance contract. Let’s assume that a pension fund has bought a bond issued by an energy company. If the price of oil subsequently falls, the energy company is not as financially sound or profitable as it was at the time pension fund made the investment. The pension fund, fearing a continued oil price decline, would like to limit its downside risk. To do so, it buys a CDS, as an insurance policy on the bond.

The policy says that if the energy company defaults the CDS seller will buy the bond from the pension fund for its remaining principal amount. For this financial protection, the pension fund pays a regular fee (called a premium) to the CDS seller. If the energy company continues to prosper, the pension fund has paid for something it did not need; but if the energy company actually does default, the pension fund has made a smart investment in buying that protection.

Large banks are natural providers of credit risk insurance for at least three good reasons. First, because large banks are diversified across the economy, they are inherently more financially stable than the energy company when economic changes occur. Banks also have ready cash to pay claims if a CDS-insured bond defaults. Finally, banks specialize in credit analysis, so they are well-equipped to assess the credit worthiness of the energy company, and for that reason are likely to charge a lower risk premium for CDS coverage than other sources of credit support.

The existence of an active market in credit default swaps also provides safety features that other kinds of financial guarantee contracts do not have. For example, in exchange for a portion of the premium it is receiving from the pension fund, the bank can hedge its risk on the pension fund bond by purchasing CDS protection from other banks or financial institutions.

Banks that sell CDS protection almost always hedge their risks this way; they carry what is called a matched book. It was AIG’s failure to do this that got it into financial trouble—a rare case of a CDS market participant that did not have a matched book. Congress did not understand, when it was drafting the Dodd-Frank Act, that AIG had taken risks that banks do not generally take, and this accounted for the so-called “push-out” rule—a mistake Congress has now corrected in the recent legislation.

As a matter of public policy, the hedging process by banks that deal in CDS also has the beneficial effect of spreading potential losses from the energy company’s default over a number of counterparties, instead of concentrating it in a single lender like the pension fund.

What we’ve described is a simple CDS transaction. While CDS contracts can be more complicated, they all basically work the same way. The bank, for a fee, guarantees another company’s obligation on its bond, something banks have always done through letters of credit.

But the basic point is that when a bank sells a CDS to the pension fund it is generating exactly the same credit risk as if it had made a commercial loan to the energy company. With CDS, however, the bank will almost always hedge this risk by buying protection from others. If we expect banks to take the credit risks of making loans—and we certainly do—there is no reason to bar them from doing the same thing, with less risk, through credit default swaps.