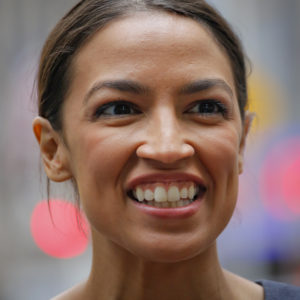

Everybody knows that New York City firebrand — and future Congresswoman — Alexandria Ocasio-Cortez supports hot-button progressive causes like the #AbolishICE movement and impeaching President Trump. But how many people are aware that she’s in favor of restoring the Glass-Steagall Act? Or that she believes “we also should make sure that no bank is allowed to become ‘too-big-to-fail’ and that oversized banks are broken up to reduce the likelihood of a financial crash?”

While the media have focused on the political consequences of the Democratic Party’s battle between passionate progressives and the party establishment, people in the banking and finance sectors may want to keep an eye on something else: The impact of this progressive shift in the party on their bottom lines.

The progressives infiltrating the Democratic Party are not only doing so at a higher rates and greater chances of success, but they’re also pushing for tighter Wall Street regulation.

For the first two years of the Trump presidency, Democrats have made few high-profile efforts to stop President Donald Trump’s deregulation agenda, particularly in the financial sector. But earlier this year, 33 House Democrats and 17 Senate Democrats rolled over when Republicans rolled back key provisions in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

But the new generation of progressive Democrats and the energized base that’s electing them is unlikely to sit quietly should they take power from the GOP in the midterms.

For one thing, anti-big-business sentiment is growing. According to an August Gallup poll, 47 percent of Democrats view capitalism positively—down from 56 percent in 2016— while 57 percent continue to view socialism positively, around the same percentage in 2010.

The Brookings Institution found that more radical, progressive Democrats are infiltrating the “establishment” Democratic Party, and more are winning primaries than ever before. They may not win enough to completely radicalize the party, but it’s enough to stop Democrats from cutting deals on financial reform with the GOP.

Alexandria Ocasio-Cortez is a democratic socialist urging her party to embrace a more aggressive regulatory agenda. Cynthia Nixon, challenging Democratic incumbent Andrew Cuomo in the New York state gubernatorial race, self-describes as a democratic socialist, and highlights a planned crackdown on Wall Street on her platform, hoping to “hold Wall Street and big corporations accountable, and strengthen protections for workers and consumers.” Win or lose, she’s made it harder for Democrats in New York—America’s financial capital—to compromise with the industry.

Ayanna Pressley, who upset Massachusetts incumbent Rep. Michael Capuano in the 7th Congressional District primary, sports a distinctly anti-big business flavor on her platform. She defeated Capuano despite the fact the he also wanted a new Glass-Steagall Act, which he introduced last year to a Republican-controlled house.

Rep. Beto O’Rourke (D-Texas), the Democrat challenging Sen. Ted Cruz’s Texas seat, decried the rollback of Dodd-Frank in March while simultaneously approving of the relief the rollback provided to community banks.

Andrew Gillum, who beat establishment Democrat Gwen Graham in the bid for Democratic nomination for Florida governor and has been called a socialist (like Ocasio-Cortez), also promotes an anti-big business agenda on his platform, and wants to raise the corporate tax rate for the state of Florida should he become governor (as mayor of Tallahassee, he raised the corporate tax rate to 40 percent).

All five of these progressives have had surprising success in their party, in part because they represent the growing anti-big business and anti-big bank sentiment among Democratic voters.

In the past, Wall Street and the banking industry have used their bipartisan generosity to make friends on both sides of the aisle. This new group of left-leaning or openly socialist democrats may mean the financial sector will have to find a new playbook if Democrats take power. Or else face the consequences.