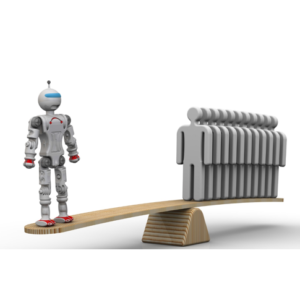

As if there were not enough uncertainty surrounding the slow-growth economy in the United Sates, robots now threaten to replace four in 10 jobs within the next 15 years or so. At least, that is, according to the latest estimate by Price Waterhouse Consultancy. When asked about robot mischief, U.S. Treasury Secretary Steven Mnuchin said he isn’t worried, and that the problem isn’t even on his radar, at least for now.

Will we be displaced by robots? The short answer is: yes and no.

According to the Association for Advancing Automation, 136,748 robots were shipped to U.S. customers between 2010 to 2016 — the most in any similar period in industry history. They point out that “in that same time period, manufacturing employment increased by 894,000 and the U.S. unemployment rate decreased from 9.8 percent in 2010 to 4.7 percent in 2016.” Sounds pretty good, doesn’t it?

In related work, MIT’s Daron Acemoglu and Boston University’s Pascual Restrepo used data for 1990-2007 to analyze the employment effects of robots on the U.S. economy and see a more pessimistic picture. They find that each new robot added correlates with about three job losses; mostly borne by blue-collar or lower-skilled workers. Their work supports the findings of think-tank analysts Adams B. Nager and Robert D. Atkinson, who note that U.S. manufacturing is not keeping pace with the overall economy in terms of real value added.

Is it possible that these assessments can both be correct? Perhaps.

Anyone visiting an automobile manufacturing plant will be impressed by the bevy of robots busily welding and assembling automobiles and the small number of workers in the same assembly areas. Common sense suggests that more robots are associated with fewer production workers when one particular plant is considered.

Common sense also suggests that more efficient robot-assisted manufacturing can increase sales and lead to plant expansions and more total employment. To estimate the net effect, we have to focus on what that plant would look like if robots were excluded from manufacturing from the very beginning, and that’s almost impossible to do.

So, what does happen to employment patterns when robots and other forms of automation reduce manufacturing employment? By looking at sector employment data — the slices that make up the employment pie — we may find the answer.

In 1970, 25 percent of the U.S. workforce was employed in manufacturing. Educational and health services employed 6 percent. Professional and business services employed 7 percent. These three sectors together employed 38 percent of the work force.

In 2017, manufacturing employed 8 percent of the workforce. Education and health services employed 16 percent — and professional and business services, 14 percent. The three sectors together still employed 38 percent of the workforce.

Across these 17 years, with the exception of the expanding leisure and hospitality sector, the employment shares for most other sectors remained about the same. Lots of manufacturing firms started contracting out functions. Factory jobs such as engineering, maintenance and payroll/accounting became service sector jobs. Meanwhile, average wages in professional and business services — the destination of many of those jobs — became higher than in manufacturing.

Ours is a robot-enhanced economy, and more are on the way. But there’s nothing in the data to suggest that American workers will run out of places to work. In fact, the data suggest there will be more job openings than qualified workers to fill them. Being qualified is the challenge, of course — and that is where our real concern should lie.