Legendary baseball player and fractured linguist Yogi Berra is claimed to have said, “It’s deja vu all over again.” Well, when we look for the descendants of British Luddites – the early 19th century protestors who smashed new weaving machines – we have only to look around to folks like British Labor Party Leader Jeremy Corbin, Microsoft founder Bill Gates, and local San Francisco City Supervisor Jane Kim, who have all called for a tax on robots. Just as Luddites were wrong in the 19th Century, the “tax the robot” advocates are wrong today.

First, they should all take a deep breath and repeat: “robots are not going to take away our jobs.” It’s easy to believe that the robots will be all powerful, coming to destroy virtually every job from janitor to lawyer to truck driver. But, despite this fearmongering, automating jobs is really hard: this is why over the last decade U.S. productivity has grown at historically slow rates. It also usually takes a very long time for technology to transform an occupation. Case in point: Otis Elevator invented the self-service elevator in 1923; it was not until around the year 2000 that most elevator operator jobs were replaced. Likewise, the automatic teller machine was supposed to eliminate bank tellers; yet there are more tellers today than 20 years ago. We will likely see a similar dynamic with truck driving jobs, as not only will trucking companies not want to replace well-functioning trucks with autonomous ones but truck makers will find that building a truck that can drive on its own, particularly in urban areas, is a complex challenge.

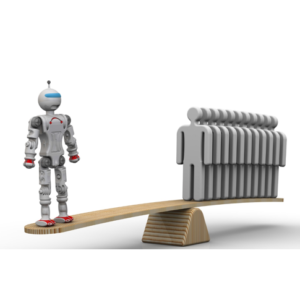

Second, robots will alter the mix of occupations in the economy and alter the nature of work performed by individual workers. It may reduce the number of some existing categories of jobs, but new jobs and occupations will emerge. Historically, improved “tools” increase productivity, which is the key to improved living standards. Making “robots” more expensive would discourage companies from adopting them, but that would slow the rate of productivity growth and lessen the standard of living for our children. And it would create an opportunity for other nations, like China, Japan and Germany, to become even more competitive and take more of our jobs.

In fact, a robot tax would likely result in fewer jobs, not more. This is because when productivity is high, unemployment tends to be lower and wage growth tends to be higher. By using innovative technologies like robots, companies invest more, consumers spend more and the national economy expands. A robot tax would mean fewer jobs and comparatively lower living standards.

Moreover, a robot tax is like Canute seeking to hold back the tides of change. Fortunately, history errs on the side of progress. Case in point: in the 1920s the Horse Association of America campaigned to limit the use of trucks on public roads and sought to prohibit automobile parking on principal streets because they wanted to protect hay growers, blacksmiths, and other related workers. But the tide toward cars didn’t stop, and cars ultimately created more jobs in positions such as auto repair workers and car assemblers. Indeed, the economic record of those changes – and many others like them – demonstrates that the adoption of new technologies ends up not only creating new types of employment, but expands incomes so consumers have more to spend: both of which mean more jobs.

It is much easier to predict and visualize the jobs that will be lost in the short term, and much harder to foresee the news kinds of jobs that will be created. This is why proponents of a tax on robots offer to apply the revenue from a robot tax to help retrain workers. Instead, policy makers should focus on accelerating the match between where the economy is going and the skills and aptitude of workers who can secure, sustain, and grow in the jobs of the future. Local and state officials should be experimenting with policy innovations like vouchers that enable laid off workers to enter apprentice or other training programs, tax incentives for employers to invest more in training, extra support for laid off workers, and a higher minimum wage.

Despite the rhetoric around robots, the truth remains that the United States has fallen behind in supporting workers and offering them the tools and opportunities to succeed in an evolving workplace. Other countries have used credentialing, apprenticeships, industry-led regional skill alliance programs, dual-enrollment programs, and have more actively engaged employers in advancing programs on science, technology, engineering, and mathematics.

A tax on robots is not the answer. Workers who fear technological progress need to be heard, but the most authentic and practically relevant response is not to stop the clock of progress. Instead, we should reinforce that we are all in this together. We can’t afford to leave anyone behind.