Imagine that the federal government received all the money it was destined to collect for the entire year on January 1. This year, that pile of cash would total $3.3 trillion. Now imagine that the government spent all the money it was destined to spend for the year at a constant daily rate. It would spend $11 billion a day. The problem is that all that spending comes to a total of $4.2 trillion, which is a lot more than the $3.3 trillion the government collected. With $3.3 trillion in hand and bleeding cash at the rate of $11 billion per day, the government runs out of money well before the year is over.

This year, the money runs out on October 19. That’s Deficit Day.

Starting on October 20, every dollar the federal government spends goes on its credit card. And who gets stuck with that bill? Not the politicians who spent the money, but the taxpayers. And not just current taxpayers, but generations of taxpayers yet unborn.

The closer the federal government comes to balancing its budget, the further toward December 31 Deficit Day falls. This year’s Deficit Day is the earliest since 2013. Putting aside the four years immediately following the Great Recession when the federal government spent at a prodigious rate, even by its own standards, the last time Deficit Day fell this early was 1992, when it came on October 15.

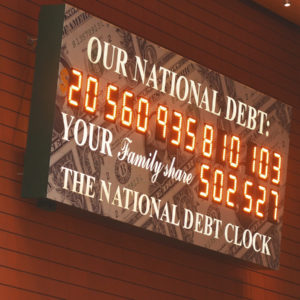

But why does government borrowing matter? Every dollar the government borrows today creates interest expense every year into the future. Currently, the government pays 2.5 percentinterest on its $21.6 trillion debt. That’s more than half a trillion dollars in interest each year, or around three-quarters of the entire U.S. defense budget. Each day earlier that Deficit Day falls increases annual interest payments by almost $300 million — every year into the future. And that’s at the current historically low interest rates.

One of the rarely noted problems of such gargantuan debt is that the federal government is running out of places to borrow to feed its voracious appetite. In order, those who have lent money to the federal government are: U.S. people and companies (32 percent of the debt); the Social Security trust fund (almost 15 percent); other U.S. government entities (almost 15 percent); foreign people, companies and governments (28 percent); and the Federal Reserve (almost 10 percent).

Since 2009, foreigners and the Social Security trust fund have been cutting back on their lending. U.S. citizens and companies are lending slightly more. But, the amount the Federal Reserve lends to the government has more than quadrupled.

This is the shape of things to come. Our government has borrowed so much money that there aren’t many places left on the planet where it can borrow more. As trillion-dollar deficits become routine and as Social Security surpluses turn into shortfalls, the Federal Reserve, the so-called “lender of last resort,” will become the lender of only resort.

And that’s where we set ourselves up for true disaster.

Today, interest on the debt costs more than four times the Department of Education and Homeland Security budgets combined. Based on Congressional Budget Office projections, within five years the amount our government spends on interest will equal the entire defense budget. Within seven years, it will equal the entire non-defense discretionary budget.

As the CBO has a solid track-record for producing optimistic projections, the reality is likely worse. The truth is that there will come a day when it is literally impossible to keep up with the payments. Responsible people call that bankruptcy. Politicians, unfortunately, call it business as usual.

Happy Deficit Day.