Editor’s Note: For an alternative viewpoint, please see Counterpoint: Trump Never Cared About Deficits and That’s a Good Thing.

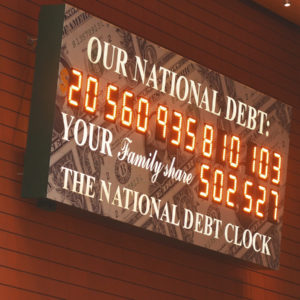

In 2016 then-candidate Donald J. Trump promised to eliminate the national debt within eight years. Instead, U.S. public debt grew by more than $2 trillion since President Trump took office and policies signed into law by the president will add an additional $4 trillion to the debt over the next decade.

What happened?

Eliminating the debt in eight years was always a pipe dream. But eliminating budget deficits within eight years is not only doable — it’s necessary.

Unfortunately, we’re not headed in that direction. Budget deals cut during the first three years of the Trump administration have sent federal spending — and deficits — soaring. Today, America’s fiscal position, already precarious when President Obama left office, is even worse.

Many on the Left point to the 2017 tax cuts as the main culprit. Yet those reforms were for the good. Combined with the administration’s deregulation initiative, they have unleashed hiring and wage growth. This surge in economic growth has been particularly beneficial for America’s most vulnerable populations, including older workers and individuals with disabilities.

It has also not resulted in the precipitous drop in federal tax revenues some had predicted. In fact, federal revenues for the first nine months of this most recent fiscal year are up 3 percent.

Still, the deficit keeps growing. Why? Because, on both sides of the aisle, Congress’s appetite for spending outpaces revenue growth. In those same first nine months, spending increased 7 percent.

Consider the last two budget deals. The Bipartisan Budget Act of 2018 — the first caps deal President Trump signed into law — increased spending by more than the two previous budget deals, forged during the Obama administration, combined.

The latest deal, worked out between Speaker of the House Nancy Pelosi and Treasury Secretary Steven Mnuchin, is even worse. Neither side wanted to be bound by fiscal rules established by their predecessors. And rather than work out a responsible budget that would reduce deficit spending, they agreed simply to discard all semblance of fiscal discipline, waive the debt limit, and clear the way for spending to their hearts’ content — soaring deficits be damned.

As if the budget deal spending levels were not already excessive, they added insult to injury by agreeing to yet more spending disguised by designating, improperly, billions of dollars as “emergency” provisions.

That may sound prudent — like establishing a “rainy day” fund. Don’t be misled. Spending designated for emergencies has become little more than slush-fund financing — a wide-open loophole for profligate members of Congress who have broad discretion over for what to use it.

Take the Community Development Block Grant. It’s used to address such “urgent and essential” national projects as paying for a brewery expansion in New York. Don’t get me wrong. I love beer, but I don’t expect federal taxpayers to subsidize production of my IPA.

There is a better way to manage taxpayer dollars. It starts with taking a close look at the federal budget and separating core constitutional functions and true national priorities from nice-to-have programs. Budgeting is ultimately about prioritizing.

Without budget limits, anything goes, including wasting hard-earned taxpayer dollars on frivolous and wasteful activities. The feds doled out $150 billion in improper payments last year. And year after year, they overpay for infrastructure projects by giving sweetheart deals to unions with project-labor-agreements and rules such as the Davis Bacon Act, which sets inflated wage rates. Taxpayers deserve better.

Polls show large majorities support limits on federal spending, as well as limits on how much Congress can run up the national debt. Both will be necessary if we are to protect younger and future generations of Americans from inheriting a crushing burden of debt and taxes.

Also necessary is the politically painful — but fiscally imperative — step of reforming entitlement programs. Social Security, Medicare and Medicaid account for the vast majority of federal spending growth, yet lawmakers don’t even set budgets for them.

What makes Social Security and Medicare spending particularly problematic is that it transfers purchasing power from younger, working families to older, retired populations. That was supportable decades ago, when America had a high ratio of workers to retirees. But times have changed. Dramatically.

It’s neither fair nor prudent to saddle young workers and struggling families with excessive debt to maintain federal retirement benefits for millionaires.

There is a better way. The Heritage Foundation’s Blueprint for Balance lays out an action plan that would eliminate the federal deficit in eight years, without raising taxes, while preserving “safety net” programs for the truly needy, strengthening national defense, and spurring economic growth.

Let’s get it done.