Imagine that the federal government received all the revenue it will receive for the year in a lump sum on January 1, and then proceeded to spend that money at a constant rate. If the federal government’s budget were balanced, the money would last until the stroke of midnight on December 31. But because the government spends more than it collects, the money runs out well before then. The day the money runs out, Deficit Day, this year falls on October 3.

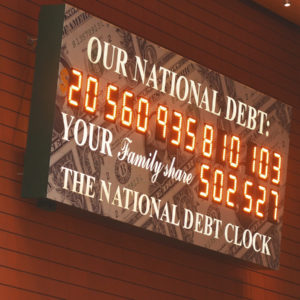

Decades of deficit spending have contributed to the government’s $22.6 trillion debt. We got to this place because politicians saw an opportunity to use economic theory to argue for ever-greater government spending. In the 1930s, the economist John Maynard Keynes argued that the government could lessen the pain of recessions by spending more money. Putting aside that this requires that bureaucrats be able to identify and react to business cycle turning points quickly, Keynes’ argument created two problems.

First, Keynes’ theory was a siren call to politicians. Keynes identified government spending as a policy tool, but politicians used it as a political tool. A politician’s goal is to get elected, and voters like politicians who spend government money in their districts. Politicians could now claim that government spending is good for the economy. How do they know? Because economics experts say so. Invoking Keynes’ theory, politicians drove federal spending from less than 15 percent of the economy after the close of World War II to 20 percent today.

The second problem was that Keynes failed to distinguish between the production of things that people want and the production of things that politicians want. In Keynes’ world, a dollar’s worth of grenades is indistinguishable from a dollar’s worth of guacamole. Consequently, increasing government spending really meant diverting society’s resources away from the production of things that people want to have, toward the production of things that politicians could use to attract votes.

But someone must pay for all the spending, and voters do not like politicians who raise their taxes. The solution politicians discovered was deficit spending.

When the government borrows to pay for deficit spending, it requires that future taxpayers pay for today’s spending via interest payments. This method of paying for government spending has become so popular among both voters and politicians that the official federal debt is now more than six times the amount of money the government collects in a year from all sources combined.

In the quest for votes, politicians promise voters more government spending. To pay for the spending without raising taxes, politicians run up deficits. As the government borrows to pay for the deficits, the annual interest expense on the government’s debt rises.

For the past decade, the Federal Reserve has held interest rates at historically low levels. Politicians tell us that low interest rates are good because they benefit people with mortgages and student loans. What politicians don’t mention is that the single largest beneficiary of low interest rates is the federal government itself. The government currently pays more than half a trillion dollars per year in interest on its debt. If the Federal Reserve were to allow interest rates to rise merely to their historical average, the government’s annual interest expense would balloon to more than $1.3 trillion per year.

That’s a likely, not a worst-case, scenario. The larger the federal debt, the greater the chance that raising interest rates will plunge the federal government into a fiscal crisis. And no one is doing a thing about it. Deficit Day stands as an annual reminder of this herculean irresponsibility, and as a prelude to the financial pain to come.

Happy Deficit Day.