Long before Donald Trump, there was an economist. His name was Arthur Laffer. He developed an idea he cleverly named after himself. It has become the First Commandment of modern Republicanism. But it was and is no laughing matter.

Laffer worked in relative obscurity until his theories were picked up by another icon: Ronald Reagan. Reagan had it all: an actor’s good looks and speaking ability; a grandfatherly demeanor. No scandals. Well, almost none (Iran Contra). No sexual peccadillos. No Mueller Report. An honorable man. Just the kind of man we needed after the tumult of the 1960s and 1970s, what with Vietnam abroad and Watergate at home.

The contrast between the beleaguered Jimmy Carter and Ronnie Reagan could not have been more stark. And so he won a huge electoral landslide, though not as big as he racked up four years later.

It was “morning in America,” the president said; not the mourning in America of the Carter years.

Only Reagan could bring a quick halt to the humiliating Iranian hostage crisis. And so he did, on the very first day of his presidency. Not a bad first act for the old actor. But even a hero has an Achilles’ heel. Despite his demigod-like electoral appeal, the president was a little fuzzy on economic policy. He needed a name to give credence to “Reaganism.”

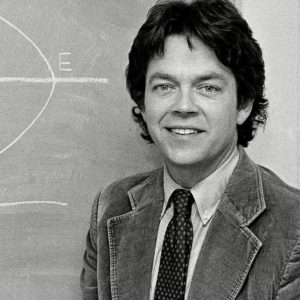

Enter Arthur Laffer. He was a professor at the renowned school of economics of the University of Chicago. There, he worked with Milton Friedman, another icon of the new GOP economic orthodoxy. He later advised Margaret Thatcher, where these new ideas were also put to the test.

But Laffer first launched his political career in California in 1976 with a popular statewide movement directed at capping high property taxes in California. From its ballot initiative number, this became known as Proposition 13. The success of Prop 13 lit a fire in the state’s Republican Party. Tax cuts were the key to revitalizing a party still trying to find an identity after Watergate. And who was nominal head of California Republicans? Ronald Reagan.

Soon Laffer’s ideas were rolled into what came to be known as “Reaganism,” or, more often, Reaganomics.

Reagan’s crushing victories in 1980 and 1984 were largely based on the Laffer Curve. This graphically showed that large tax cuts were not the harbingers of huge budget deficits, as “tax and spend” liberal Democrats warned. These cuts would, in fact, “pay for themselves” with the huge tax revenues that would flow in as a result of the business expansion created by the tax cuts.

So, you see, the United States could party-hardy now and not have to worry about the hangover later. Laffer’s Curve would take care of everything. And boy, was it a vote-getter. Reagan, both Bushes, and Trump all looked to the Laffer playbook for their economic strategies. Huge tax cuts. Booming economies. No deficits. What’s not to like?

So what IS my problem? Easy: The Laffer Curve is bogus.

People at the top get most of the benefits. The rich get champagne; everybody else gets tap water.

This prosperity turned out to be, to use the contemporary parlance, fake news. In practice, revenue coming in from the tax cuts stubbornly refused to cover government expenses. Government coffers steadfastly refused to overflow.

Laffer’s budget surpluses never materialized. This, in turn, forced huge borrowing by the feds. Over 40 years, this has burdened the nation with ginormous annual deficits, several times exceeding $1 trillion. In fairness, these deficits were racked up by both parties. Barack Obama ran up that much red ink four times; Trump once (so far). The total national debt is now more than $23 trillion. This will stymie our economy. Worse, it will burden our children with debts they never had a say in and can never repay without drastic tax increases and/or spending cuts.

So where are we now and what can be done? Somewhere between the proverbial rock and a hard place. The economy now depends on the stimulus provided by government deficit spending. To balance the budget now would trigger a catastrophic recession that would make the so-called Great Recession of 2008-09 look like child’s play.

We must insist that politicians work toward reducing the growth in the budget shortfall by raising taxes, especially but not only on those making more than $400,000 a year. We should return to the policies we had when we last had a surplus, in the 1990s. Then, taxes on the rich were 39.6 percent. That strikes me as about right.

This must be combined with some difficult but necessary reductions in federal spending. These cuts must be more or less across the board. Each government department should be required to come up with a list of cuts, in the area of 10 percent.

I would exempt some social programs, but even they could use some fine-tuning in the interest of our nation’s economic health. Defense, which has ballooned to more than $700 billion under Trump, can take a sizable reduction without endangering our national security.

Let’s quit saying, as Mitch McConnell once did, “deficits don’t matter.” And above all else we must bury Arthur Laffer and his Curve once and for all.

It’s just not funny anymore.