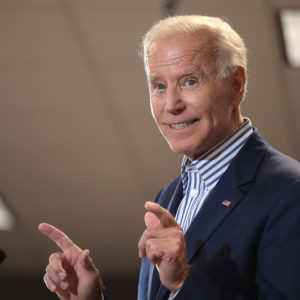

President Joe Biden’s forthcoming “Made in America Tax Plan” is designed to pay for his $2 trillion “infrastructure” plan. Details are forthcoming as part of the president’s Fiscal Year 2020 Budget.

Last year, candidate Biden promised to repeal the “Trump Tax Cuts” that lowered tax rates for everyone and especially corporations. Biden also promised not to raise taxes on incomes of less than $400,000 per year.

But terms are redefined constantly by progressives. Rep. Mondaire Jones (D-N.Y.), for example, tweets that “Supreme Court expansion is infrastructure.” What isn’t?

You will be told that the tax plan only taxes the wealthy. Untrue. Corporations do not ultimately pay taxes – they collect them. Their “promise” won’t include intergenerational transfers of property and assets, like houses, family businesses, family farms, and stock.

Meet stepped-up basis. Here’s how that works. Say you’re a 60-year-old almost-retiree whose 90-year-old parent just passed away. You are bequeathed their Florida home acquired in 1980 for $100,000. Its value is now $500,000. Hopefully, it won’t be complicated by a reverse mortgage or isn’t burdened by other forms of leveraged debt. You sell it for $500,000. Thanks to “stepped-up basis,” you should owe no federal capital gains tax on the sale.

But what happens if all this happens after Democrats eliminate this so-called “loophole?” You’ll owe capital gains taxes on the gain in value since the property was purchased 41 years ago, most of which is probably inflation. That’s a likely 20 percent tax hit on the “gain” of $400,000 – some $80,000 to Uncle Sam. For people with incomes over $1 million, Biden may raise Capital Gains taxes to match the highest personal income tax rate of 39.5 percent.

The Biden plan may exempt the first $1 million of “unrealized” gains, but that’s a shallow threshold for many family businesses and farms. And it is not just homes or beach property. It includes stocks and family businesses.

Being allowed to keep your or your family’s own money is now a “tax loophole.” And five Democratic senators are poised to lead the fight to end it. “The stepped-up basis loophole is one of the biggest tax breaks on the books, providing an unfair advantage to the wealthiest heirs every year.” said Sen. Chris Van Hollen (D-Md.).” And wealthy heirs who call themselves “Patriotic Millionaires” are happy to be generous with your money as well.

Thanks to budget and reconciliation rules in Congress, Republicans can’t stop them with the Senate filibuster. Democrats only need a simple majority to pass the bill. At least Senate rules will not allow them to include eliminating the Electoral College, making the District of Columbia a state, or increasing the size of the Supreme Court. For now.

Whose money do the Democrats think we’re talking about? They seem to think all money is the government’s, and they’re letting you keep some of it. They clearly believe that they can spend it better than you. It doesn’t take long before that extends into other private property. Your pensions and IRAs may be next.

Consult your financial and tax advisors, especially if you’ve done the responsible thing and invested wisely, took risks to build a family business or a farm, and saved some money to pass along to your heirs, most of it without the help of a government program, and often in spite of them.