American college graduates face an unprecedented financial crisis. Never before, in our nation, have so many young people been so deeply in debt, with the latest estimates putting total student loan debt at $1.2 trillion, with the average student loan balance of nearly $30,000. By nearly any measure, economic participation among millennials is lower than it was for their parents’ generation. The financial crisis and a tepid job environment alone are enough to dissuade a recent graduate as he or she enters the workforce. Add the burden of loan debt and students have no choice but to take drastic measures to reduce expenses. Many are staying home, taking lower paying jobs in cheaper parts of the country, or taking second jobs. American graduates are tightening their belts and delaying major life events to service debt. Student loans are proving to be an enormous roadblock to buying homes, marrying, investing, and consuming. This harms America’s economy.

We propose a simple solution: Allow graduates to pay off student loans with pre-tax income. Similar to the commuter benefits and pre-tax retirement incentives (think 401K) most Americans are familiar with, allowing students to pay off their loans with pre-tax dollars will have two enormous benefits. First, it will aid recent graduates in paying off their debts while increasing their economic activity. Second, it will benefit federal, state and local governments through increased economic efficiency, jobs, and cost reductions.

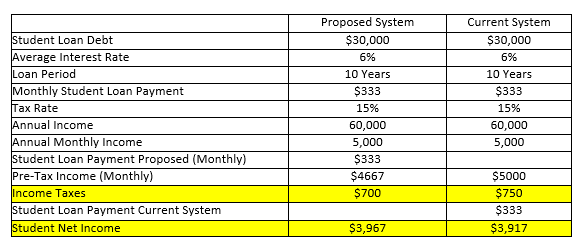

Allowing student loans to pay off pre-tax will save young people money. Let’s use the example below:

Two things become immediately apparent. Under the current system, the government collects an additional $50 in taxes per month ($750 vs $700) and the graduate takes home less money ($3,917 vs $3,967). Under our proposed system, the $50 goes to the student instead of the government. While $50 a month might not seem like a lot, that’s still a gym membership, a night out for dinner every month or, even better, additional payments on student loans to more quickly reduce debt. That $50 would create multiple spillover effects into the economy, providing a new source of revenue for American businesses. Applying this model to the total student loan balance of $1.2 trillion results in over $13 billion dollars in savings per year for young Americans.

The natural push back is that the benefit to students is at the expense of government revenue. However, when considering collections, the operational cost of student loans is quite high. Critics of the federal government’s loan plans, notably Senator Elizabeth Warren, state that the government makes an egregious amount of money, as much as $50 billion annually, on student loans. However, the government’s method of accounting for these loans is suspect, using an unconventional cash method, as opposed to a more standard “fair-value method.” The CBO projects that by using fair value accounting, the government’s profit this year would be just $6 billion. This is far less than the $50 billion touted by some student loan reformists, and essentially quantifies the immense cost of collection that the government incurs every year.

Using the implied $44 billion ($50BN -$6BN) as a baseline for cost to collect on student loans, any program which reduces the cost of collection would yield billions in savings for the federal government. If we assume the government reduces its collection costs by 50% when collecting loan payments in the same manner it collects FICA, Social Security, and payroll taxes, then our proposal saves the government $20 billion. The reduced collection costs alone will offset the lower tax revenue collected directly from students. At the same time, increased student saving, spending, and investment will stimulate economic growth and increase tax revenue.

The economic drag caused by a heavily indebted young adult population will have numerous long term negative consequences. The purpose of a pre-tax deduction is to create an incentive for people to be reasonable with their money and plan ahead for the future. Student loan debt is a back-burner issue in Washington — politicians write off the youth vote, especially since turnout is notably lower for people under 35. The current default in Washington is to kick the can down the road, hoping that someone in the future will come up with a clever way to solve the problem. We think our plan is a piece of the solution. It would not only be easy to implement, but immediately beneficial not just to recent graduates, but to all Americans. A fully comprehensive plan would not only address payment and servicing of debt, but also the rising price of a college education. Such a comprehensive plan would call into question the merits of government subsided student loans, and how these loans create perverse incentives for universities, incentivizing bureaucracy and discouraging efficiency.