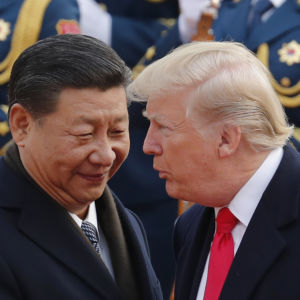

Following President Donald Trump’s renewed threat to impose a 25 percent tariff on $200 billion worth of Chinese goods, a Chinese delegation will travel to the U.S. to discuss trade with White House, according to CNBC.

Telecom trade groups quickly decried the 10 percent tariffs announced in September 2018, claiming they would cost the telecom equipment industry “hundreds of millions of dollars,” but haven’t yet commented on Trump’s newest tariff threat.

Federal Communications Commissioner Jessica Rosenworcel also decried the Trump administration’s tariffs in an op-ed for Politico last fall, arguing they would make 5G deployment “much more expensive” and hurt the U.S.’ chances of winning the 5G race. When Trump revived his tariff threat yesterday, she tweeted her op-ed again, adding, “[tariffs] will jeopardize our efforts to lead in #5G wireless technology.”

But the tariff likely won’t slow 5G deployment that much, according to the R Street Institute’s Technology and Innovation Policy Team Manager Tom Struble.

On the other hand, the tariff could further hinder competition within the telecom industry and hurt efforts to close the digital divide, because the brunt of the tariff will fall on small, regional and rural carriers.

Because the telecom industry is a capital expenditure-heavy industry, it’s harder for upstart telecom companies to make a profit and compete with Big Telecom. The high upfront costs in wireline and wireless infrastructure usually result in big companies like AT&T, T-Mobile and Verizon buying up the smaller ones. In other words, high capex industries naturally consolidate more than low capex ones.

While Big Telecom may swallow the tax more easily and see only a small dent in their profits if the 25 percent tariff goes into effect, smaller telecom companies trying to serve rural areas may suffer the most.

“In terms of wireless infrastructure, those are only being made by three companies right now, and Huawei is the global leader,” Struble said. “[The tariff] would directly impact any ISPs and wireless carriers buying equipment [from Huawei]. Generally slowing deployment, that’s not a big deal because the big carriers have already stripped out Huawei equipment and have pledged not to use any going forward. It does affect smaller rural and regional carriers, the ones that have less money. Some still use Huawei equipment and may want to [continue to] use Huawei.”

Small carriers like to use Huawei is because Huawei offers the lowest prices for telecom equipment. That’s a big deal when you’re a small, rural company.

But further complicating the issue is the fact that many American telecom manufacturers send parts for semiconductors and chips over to China for assembly. Tariffs hit the finished product, then, upon reentry to the States.

“We’re only hurting ourselves on both ends with these tariffs,” Struble said.

In the past, tariffs have not had a significant long-term effect on economic growth. Furthermore, several recent reports from within the telecom industry suggest the U.S. is neck-to-neck if not ahead of China in the 5G race. First Cisco said the U.S. is doing way better than pundits say it is.

The CTIA, a telecom industry trade group, also just released a new report stating that the U.S. is “tied for first” with China when it comes to “5G readiness.”

“America’s wireless industry continues to be the global leader in making the commercial investments and preparations necessary for 5G deployment,” the CTIA said in the report. “America leads the world with the most commercial 5G deployments of any nation, and deployments are happening all across the country.”