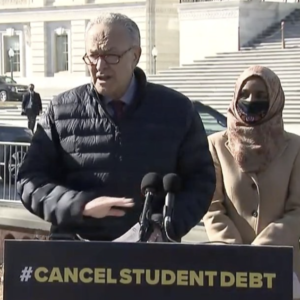

On Thursday, a group of Democrats from the U.S. House and Senate held a presser touting their proposal to have taxpayers pick up the tab for up to $50,000 in college debt per student.

Senate Majority Leader Chuck Schumer, D-N.Y., was there, along with Sen. Elizabeth Warren, D-Mass., and Reps. Ayanna Pressley, D-Mass., and Ilhan Omar, D-Minn. According to Pressley, more than 50 members have signed off on their nonbinding resolution to let borrowers off the hook.

New Hampshire’s delegation, however, was a no show. So, do they support student debt forgiveness? Oppose it?

Our state’s four federal representatives won’t say.

NHJournal has been asking Sen. Maggie Hassan to share her position on student loan debt forgiveness for months. No comment.

We requested a comment about Thursday’s event from the entire delegation. Again — silence.

“The student debt crisis is a racial and economic justice issue,” Pressley said. “With this pandemic worsening daily, we need bold and high impact policies that will match the scale and scope of the crisis and truly offer immediate relief for people—this must include across the board student debt cancellation.” She says Biden can take this action — which would cost taxpayers about $1 trillion — via executive fiat.

Do New Hampshire’s Democrats agree?

White House spokesperson Jen Psaki answered questions about the Democratic proposal at Thursday’s presser, saying that President Biden supports a more modest plan. “The president has and continues to support canceling $10,000 of federal student loan debt per person as a response to the COVID crisis.”

That would cost taxpayers about $370 billion. Psaki also said Biden rejects the executive action argument.

“He’s calling on Congress to draft the proposal. And if it is passed and sent to his desk, he will look forward to signing it,” Psaki said.

So, if Congress drafts a student debt forgiveness plan, how many members of the NH delegation will support it?

As of today, the answer continues to be “nobody knows.” Given how unpopular the idea is among non-college graduates and those who paid off all their debts without getting any tax money, perhaps the politics is too problematic.

And despite Rep. Pressley’s claims, multiple studies show student debt money goes disproportionately to wealthy, white people as opposed to low-income black or Hispanic borrowers.

“Student debt is concentrated among high-income households because people with expensive degrees tend to be richer,” Preston Cooper of the Foundation for Research on Equal Opportunity told NHJournal. “Meanwhile, people with only a high school degree – who have been hit hardest by the COVID-19 recession – will hardly get anything out of the plan.”

A working paper from the National Bureau of Economic Research by economists Sylvain Catherine and Constantine Yannelis concluded that universal student loan “forgiveness would benefit the top decile as much as the bottom three deciles combined.”

Yannelis confirmed that finding to NHJournal. “Most of the benefits of the policy would accrue to upper-income individuals, which is similar to other regressive policies such as the mortgage interest tax deduction and SALT [state and local tax deductions].”

While New Hampshire is among the top 10 states when it comes to educational attainment, just 36 percent of Granite Staters have a bachelor’s degree. And most of those either paid for their education out of pocket, saved in advance, or have already paid off their debts.

Schumer, Warren, Pressley, and President Biden have committed themselves to shifting billions in debt from the borrowers to the taxpayers. Will Hassan and Shaheen join the effort or stand in opposition?

So far, no comment.