Iowa Governor Kim Reynolds unveiled her long awaited tax reform package via press release Tuesday, aimed at reducing Iowa income taxes by a minimum $1.7 billion by the year 2023, highlighted by the removal of Iowa’s federal deductibility and lowering income tax rates by a collective 23 percent.

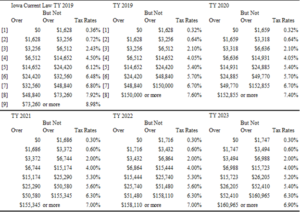

Under Reynolds’ plan, Iowa’s nine income tax brackets would be consolidated into eight, ranging from $0 to $150,000 and over. Each fiscal year beginning in 2019, the aggregate tax rates decline, while in contrast, the income brackets increase in dollar range (see figure 1).

Figure 1: Iowa’s current tax code and nine brackets, as they compare with Reynolds’ reduction to eight brackets and adjusted income levels. Photo Courtesy of Governor Reynolds

According to the Reynolds Administration, in the current tax code, the top tier rate for individual income is 8.98 percent, which is “fourth highest in the nation.” The new proposal reduces that rate to 6.9 percent by 2023 and adjusts the impact for those with income above $160,965. Currently, income above $73,260 is taxed at 8.98 percent. According to Dr. Ernie Goss, MacAllister Chair in Economics at Creighton University, the tax rate for those high income earners is still fairly high.

“That’s still a bit high for high income individuals,” Goss said. “You’re still in a marginal tax rate that’s fairly high for high incomes. That’s high relative to some of Iowa’s neighbors in Missouri and Nebraska. The rest of them have fairly high rates as well.”

According to Goss, the best aspect of the Reynolds’ proposal is the elimination of federal deductibility, in that it provides more transparency to Iowans and to Iowa’s neighbors. Because of federal deductibility, Goss said, Iowa’s high income tax rates have been able to remain a non-factor because Iowans could always deduct their federal taxes from their income taxes. However, with the recent federal tax reform lowering taxes across all brackets, Iowans’ liability to state income taxes will increase because they are losing less of their income to federal taxes.

“It’s hard for an individual and businesses to gauge what real rates you’re facing so I think that’s a really good thing Iowa should have done many years ago so that your rates are comparable among states,” Goss said.

Also part of Reynolds’ proposal is the raising of the standard deduction from $2,070 to $4,000 for single filers, and from $5,090 to $8,000 for married filers. There would also be an additional standard deduction increase of $1,500 for the elderly and blind in 2019, rising to $2,070 in 2021.

As to the impact of Reynolds’ plan on families, Reynolds laid out several scenarios:

A typical single parent, with one child, making $30,000, will see a 28 percent tax cut next year [2019]. By 2023, she’ll see a 54 percent cut.

A typical family of four making $55,000 will see a 10 percent tax cut next year [2019]. By 2023, they’ll see a 23 percent cut.

A typical family of four making $70,000 will see an 8.7 percent tax cut next year [2019]. By 2023, they’ll see a 20 percent cut.

According to Ryan Koopmans, chief policy advisor for the Reynolds Administration, the groups of people that will be impacted most if Iowa tax reform does not happen, are families. This is due to the fact that the child tax credit increased at the federal level, which means their federal taxes decreased, which means they can’t deduct as much for their state income tax, which is costing them money for having children, compared to other individuals who make similar incomes but do not have children.

One portion of the proposal that the administration is using to help offset tax rate decreases is taking a harsher stance on online sales and a lack of sales tax being collected on online purchases. According to Goss, residents are “technically” supposed to be saving their receipts from online sellers that do not charge sales tax, and paying the state a “use” take equal to a standard tax rate.

However, Goss said, if the administration were to go after those use taxes, the administration would become unpopular fairly quickly.

As it stands currently, the Supreme Court of the United States (SCOTUS) is hearing a case that impacts the ability of a state to charge sales tax to a business whose operation does not exist within the state. Under current law, only Congress can make laws regarding interstate commerce.

“We’re going do a couple things,” Koopmans said. “We’re going to get more aggressive with nexuses, that’s kind of a decision that is dependent on, to some degree, Quill. But we’re also going to do things based on who the seller is. So if there is an online market place that has a nexus in Iowa, they’re a seller in Iowa and therefore they need to collect the taxes that they’re selling from a business far from Iowa. We’ve exempted digital goods for some time, I assume the theory being that we wanted to encourage the internet but now internet is killing the physical. If you buy a book, you pay sales tax. If you download a book from Barnes & Noble and it goes on a Kindle you pay no sales tax. Now we’re going to treat like products the same regardless of the medium in which you buy them and that’s not dependent on Quill.”

One of the final portions of the proposal is in addressing small businesses in the state, which Goss points out are are predominantly independent farmers. Under the proposal, Iowa business owners will be able to deduct 25 percent of the new federal Qualified Business Income Deduction from their Iowa taxable income. Additionally, the section 179 expensing limit will increase immediately from $25,000 to $100,000.

“You’ve got a lot of agriculture and farming, a lot of farmers take advantage of that 179 benefit,” Goss said. “The problem is right now that benefit is only good when you have farm income. Right now for agriculture, even with the 179 expansion, farmers have pulled back on their purchases. Whether it’s $25,000, $50,000 or $100,000, you’ve still got the issue of agriculture commodity prices are just not there. Even with an expanded 179, that’s not going to have the impact it would have had five years ago.”

Reynolds’ tax plan comes as the legislature still cannot agree on a bill that comes up with congruent budget cuts to fill a $34 million hole in the state’s fiscal year 2018 budget. According to the officials, revenue in Iowa is growing, but not at the rates anticipated by the Revenue Estimating Conference, which is what’s been resulting in back-to-back mid year budget cuts. Goss said that a tax cut at a time where revenues are growing slowly could continue to slow revenue.

“The problem is right now, farm income has heavily declined since 2013, and has been declining ever since,” Goss said. “In 2018, the [U.S. Department of Agriculture], thought farm income sales in 2019 were going to be better, but according to USDA data, its not going to be. The point is that states in this part of country are dependent upon crop income, and it’s going to be another year of challenges. That’s going to spill over into the state and those [revenue] estimates may come down each month and continue to go lower because a lot of individuals expected farm incomes to be up and that’s not going to be the case on the crop side.”