Republicans and Democrats across Capitol Hill are taking issue with the Federal Communications Commission’s plan to deregulate business broadband providers ahead of an agency vote Thursday.

Democrat Sen. Ed Markey of Massachusetts and Republican Sen. Tom Cotton of Arkansas are among lawmakers who sent letters to FCC Chairman Ajit Pai highlighting problems with the proposal commissioners are scheduled to vote on Thursday.

Known to the agency as business data services (BDS), the BDS market provides high-powered, high-speed internet to businesses, hospitals, libraries, schools, public safety offices, ATM networks, and wireless carriers. Such networks are “often used when a consumer makes an ATM transaction, swipes a credit card at a local gas station, or uses a smartphone to make a call, send a text, or search the internet,” Markey and Pennsylvania Democrat Rep. Mike Doyle wrote Tuesday.

Pai’s proposal would deregulate certain BDS markets with one competitor “nearby” or within “a half mile,” essentially allowing a duopoly to meet the new Republican FCC’s standard for competition (his predecessor, Democrat Tom Wheeler, sought to do the opposite and increase regulation before last year’s election).

Democrats asked Pai to postpone the vote, pointing to more than a decade of FCC data gathering on the market that found 73 percent of BDS locations are only served by one provider and 97 percent served by only one or two. According to smaller BDS providers like Sprint and Level 3, who lease network space from incumbents like AT&T and Verizon (mandated by the very FCC rules Pai is seeking to change), that lack of competition has led to unfair pricing and contract terms that ultimately raise the price of services for consumers by billions annually.

“The Small Business Administration’s Office of Advocacy raised concerns that this BDS proposal could result in fewer BDS choices and higher prices for small businesses across America,” the Democrats said.

Under Pai’s order the FCC would consider a county competitive if 75 percent of its census blocks were served by a cable provider, though the FCC itself has said cable isn’t as powerful and doesn’t make up a significant segment of the market. According to the SBA, if the FCC goes through with the order and prices increase as they expect, small business will be forced to downgrade service “or pay monopoly rates in the absence of real substitutes or price regulation.”

AT&T has already announced an imminent price hike for its BDS services on the heels of the FCC’s plan to deregulate business broadband. Texas, Missouri, Arkansas, Ohio, Indiana and Wisconsin “are among those affected by the intrastate hike,” according to Politico.

“Further, should this order be implemented immediately and without any transition period, the businesses and consumers relying on BDS could experience disruptive price increases,” Markey and Doyle wrote.

Arkansas Republicans Cotton, Sen. John Boozman and Rep. French Hill agreed, and asked Pai to delay the effective date of the plan in order to help businesses cope.

“A transition period would create a window where all market participants could plan for price increases or the purchase of internet protocol (IP)-enabled equipment, shop for alternative service arrangements, and even solicit build-out proposals from potential market entrants,” Republicans wrote. “A reasonable transition would also enable service providers to adapt and remain viable in more markets than will occur in the event of a flash cut to new policies.”

Cotton took heat during a town hall in Little Rock on Monday for voting to repeal another set of the previous FCC’s rules that would have prevented internet service providers from collecting and monetizing subscriber browser history and app usage.

Critics of Pai’s plan to deregulate business broadband say current FCC data, which already demonstrates a evidence of a monopoly and duopoly market, doesn’t take into account several recent buyouts of smaller providers by big incumbents. Verizon’s purchase of XO Communications, Windstream’s acquisition of Earthlink, and CenturyLink’s pending bid to buy Level 3 will further consolidate the market.

“The BDS order is another in a long list of issues on which Chairman Pai has chosen to side with the biggest telcos and cable companies possessing market power instead of the public interest and consumers,” Phillip Berenbroick, senior policy counsel at the pro-net neutrality group Public Knowledge said on a conference call with reporters Tuesday.

During the same call Michael Calabrese of the Open Technology Institute, a progressive-leaning think tank, said the order could slow mobile broadband and the deployment of 5G, since wireless carriers already spend as much as 30 percent of their operating costs on BDS to carry the “backhaul” of broadband traffic to cell towers.

“Wireless carriers pass on the high cost of backhaul to consumers through increased retail prices, which also negatively impacts efforts to close the digital divide,” Calabrese added, with the last part a reference to what Pai describes as the chief goal of his chairmanship.

Chip Pickering, the CEO of INCOMPAS, which represents small competitive BDS providers, said the FCC was threatening to set a dangerous precedent by describing markets with one or no competitors as “robust” or adequately competitive in its plan to deregulate business broadband.

“Speaker Paul Ryan held his press conference two weeks ago talking about the insurance market, and in that market you have a third of the counties in that market with only one choice, many only two, and he’s describing that market as in crisis and facing collapse,” Pickering said. “The broadband and business data services market is much worse.”

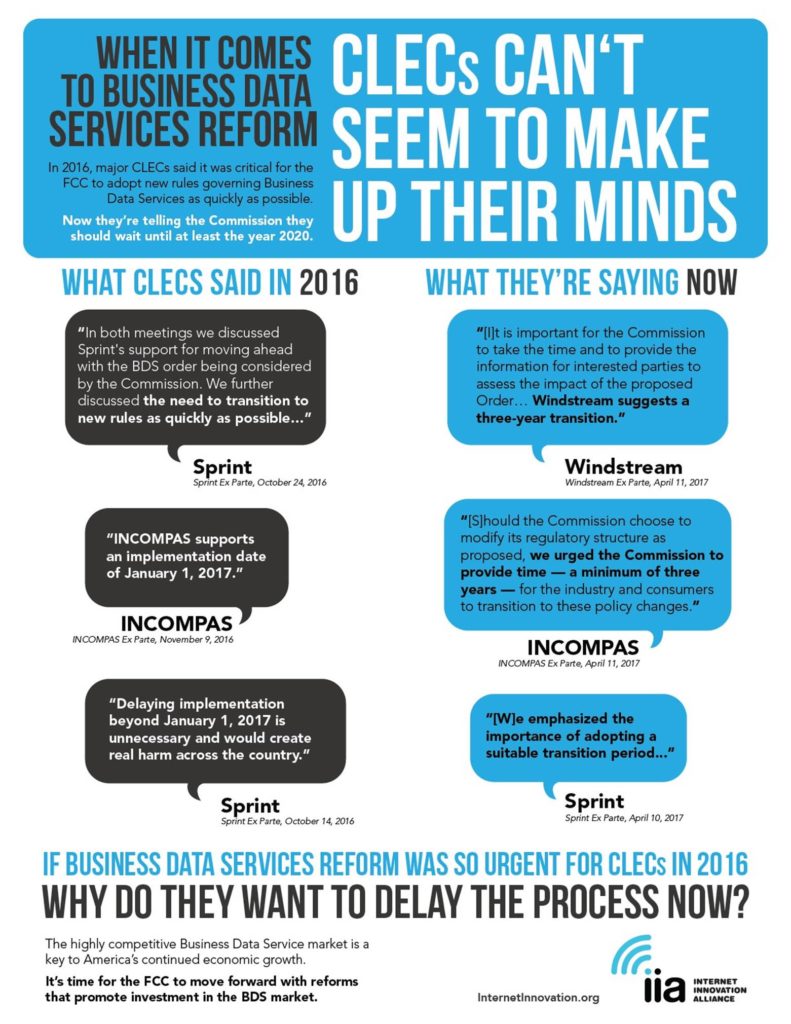

The Internet Innovation Alliance — a policy group whose members include AT&T — released an infographic this week that shows how the tables have turned since the previous FCC released its plan for increased BDS regulation. The graphic paints groups like INCOMPAS as hypocritical for urging the FCC to quickly pass Wheeler’s plan, despite protests from incumbent providers to delay it for more data analysis.

The FCC is scheduled to vote to deregulate business broadband during its open meeting April 20.