California has some of the most expensive rent in the nation. In its major cities, such as Los Angeles and San Francisco, rents pierced the $3,000 level before the global pandemic hit.

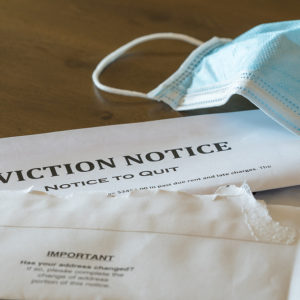

As a response to the pandemic, back in March 2020, Gov. Gavin Newsom imposed the nation’s first statewide shutdown. Along with that, he placed a moratorium on evictions. Landlords were allowed to use the program to collect aid equivalent to 80 percent of the rent if they agreed to forgive the final 20 percent.

But this was a completely voluntary program, so in an instance where the landlord refused, then the tenant could receive 25 percent of their rent and their debt to the landlord could be taken to small claims court in lieu of the landlord being allowed to institute eviction proceedings.

The real issue today is that California still has the resources- an estimated $5.2 billion of federal money – to help tenants, and the legislature extended the plan through September 30. Newsom’s projected $7.2 billion plan, which he called the “largest and most comprehensive renter protection deal in the United States,” is retroactive, covering both rent and utilities dating back to March 2020. The plan is for the $5.2B of federal government money to cover rents, with California kicking in an additional $2B for utilities.

Jeffrey J. Zenna, an attorney with Blume Forte Fried Zerres & Molinari, sees this as an issue that extends well beyond California. “What’s going on in California this week remains an issue in every state. 18 months ago, few people would have predicted that so many people in each state would still be feeling the effects of the pandemic in the summer of 2021, but here we are. Many legislatures are working to find ongoing humane ways to balance the obligation of tenants and the financial realities of landlords.”

California has deeply felt the impact of the pandemic, with a Berkeley study published this month finding that the number of California families unable to pay rent had doubled since the dawn of the pandemic.

Those applauding the announcement by California’s governor – made in the midst of the process to recall him – recognize that the deep divisions in California society have fueled the disparate impact the crisis has had on people:

A recent piece in the San Jose Mercury News frames this perfectly: “Let’s ponder how different the treatment was for the ownership world vs. rental.

Owners, the ownership industry, and mortgage makers got a massive, largely federal bailout that helped many participants who didn’t actually need financial assistance.

Conversely, the rental slice of the housing market — a decidedly lower-income populace — and their landlords, many of whom are mom-and-pop owners, got the equivalent of cake crumbs.”

While $7.2 billion is by no means cake crumbs, it’s simply a vehicle to allow renters and landlords to begin to regain their footing. No one is going to get rich off California’s extension of the eviction ban and the accompanying relief. But it may be just the leg up that so many need right now.