The Republicans who gathered at the State House in Concord on Wednesday were hardly subtle about their view of taxes.

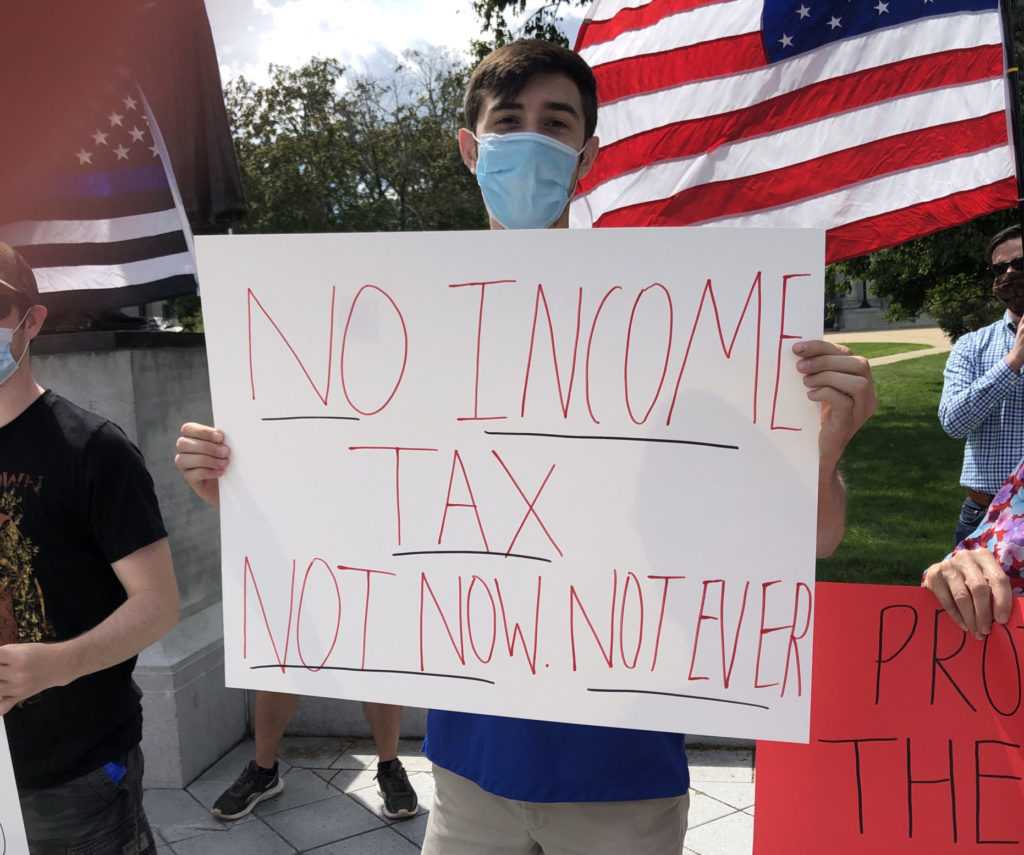

One sign read, “Protect the New Hampshire Advantage,” a reference to the Granite State’s lack of a sales or income tax. Another said, “No Income Tax. Not Now. Not Ever.”

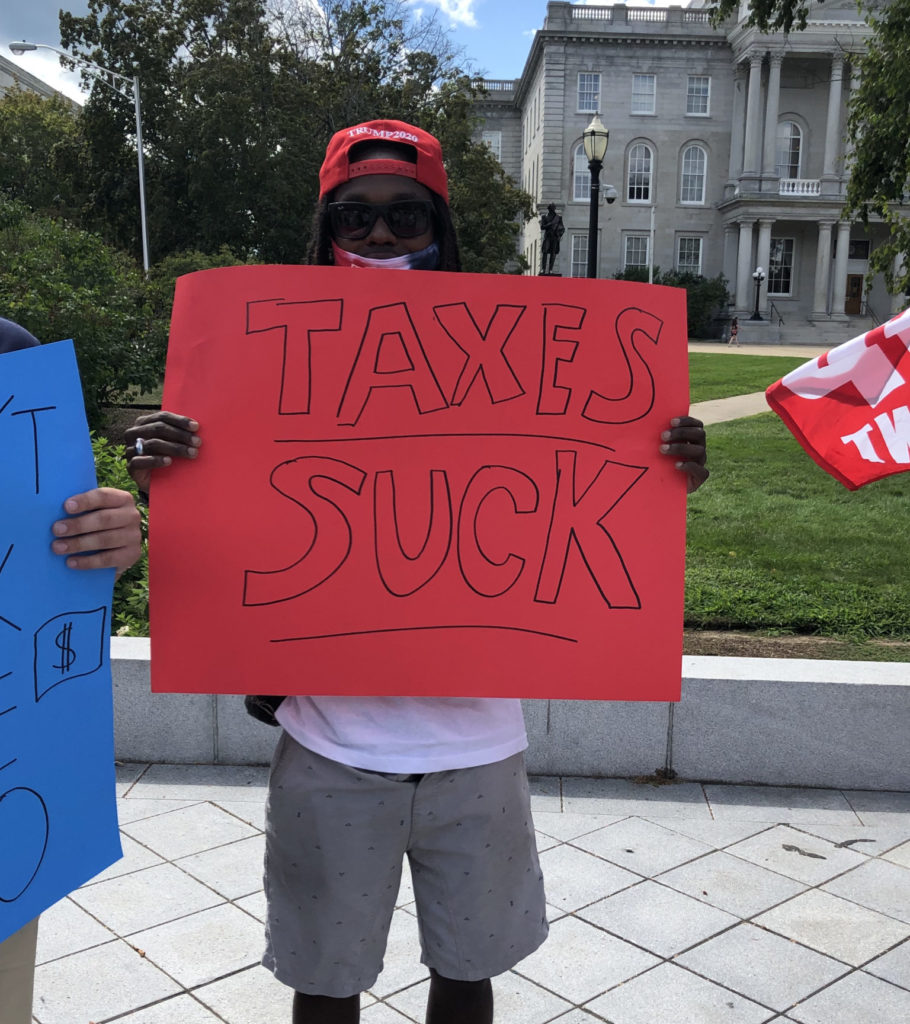

And one simply read: “Taxes Suck.”

The anti-tax rally was organized by President Trump’s New Hampshire campaign, part of a week’s worth of counterprogramming to the Democrats’ convention.

Speakers included the co-chair of the Trump N.H. campaign Rep. Fred Doucette, NHGOP U.S. Senate candidate Corky Messner (who’s facing retired Gen. Don Bolduc in the primary), and GOP legislative leaders Rep. Dick Hinch and Sen. Chuck Morse.

Their message: Democrats are going to raise taxes. Period.

“The Democrats have had no problem putting an income tax on the governor’s desk three times,” Morse said, referencing Democratic paid family medical leave bills financed via a tax on wages. “I don’t believe that is good for this economy.”

“I firmly believe in the ‘Live Free or Die’ state and delivering socialism to this country is wrong,” Morse added.

Hinch was just as outspoken in declaring the Democrats’ paid leave bill an income tax (a disputable claim), and the House minority leader made a bold prediction about how the 2020 legislative season will end on Veto Day next month.

“The governor vetoed 57 crazy bills last year. This year he’s vetoed 22. Last year, out of 57 vetoes, Republicans stood united and sustained 55 of the 57. This year, Veto Day, September 16, fasten your seatbelt because, of Sununu’s 22 vetoes, 22 will be sustained.

“You can take that to the bank,” Hinch said.

Several speakers pointed out Joe Biden’s pledge to raise taxes by pushing to return tax rates to their pre-Trump presidency levels. According to left-leaning Factcheck.org, “The vast majority (82 percent) of middle-income earners — those with income between about $49,000 and $86,000 — received a tax cut that averaged about $1,050.”

But polls show that for some Americans, the tax issue has been eclipsed by other concerns, most notably the coronavirus pandemic. A new Pew Research poll of voters’ top issues finds the economy at the top, followed by healthcare, Supreme Court appointments and COVID-19.

However, a Rasmussen Reports poll taken around the same time says 66 percent of likely voters say taxes are important in their vote for president and 35 percent say the tax issue is very important.

Which one is it?

One way to measure an issue’s power is to watch how politicians — who need votes — handle it. In New  Hampshire, Gov. Sununu frequently touts his pledge to veto any and all broad-based income taxes.

Hampshire, Gov. Sununu frequently touts his pledge to veto any and all broad-based income taxes.

Across the aisle, Democrat state Senate Majority Leader Dan Feltes has also taken The Pledge in his race for governor. But his opponent pointedly has not.

Executive Councilor Andru Volinsky has not only refused to pledge to oppose income or sale taxes, he dismisses the notion as a “Republican talking point.”

Instead, Volinsky has created “the pledge of the future.” It says: “If I am elected governor, I pledge not to balance the state budget on the backs of local property taxpayers, but instead I will reduce local property taxes for the majority of our state’s citizens.”

And he’s made it clear that he’s open to creating a New Hampshire income tax as part of that effort.

The net impact on the Volinsky candidacy is that, in the latest UNH Granite State Survey, he’s doing slightly better in a match-up against Sununu than Feltes.

“Historically, any candidate with an inclination towards introducing an income tax in New Hampshire was likely dead on arrival,” New England College politics professor Dr. Wayne Lesperance told NHJournal. “Perhaps the most recent example was gubernatorial candidate Mark Fernald who made an income tax central to his campaign. There was very little tolerance for that position then.”

(Fernald lost by 20 points to Republican Craig Benson.)

“Today, it doesn’t appear there remains the same hostility towards such a tax plan. While certainly Granite Staters remain predisposed against more taxes, there seems to be some tolerance for them by Democratic voters supporting Volinsky. Whether that’s a product of the changing demographics of New Hampshire’s citizenry or the influence of COVID-19 is not known,” Lesperance said.